Brent crude oil futures increased above $56 a barrel following BP‘s announcement to cut capital expenditure this year.

Reuters reported that Brent crude oil futures increased $1.90 to settle at $56.65 a barrel, while US WTI futures rose $1.51 cents to settle at $51.08 a barrel.

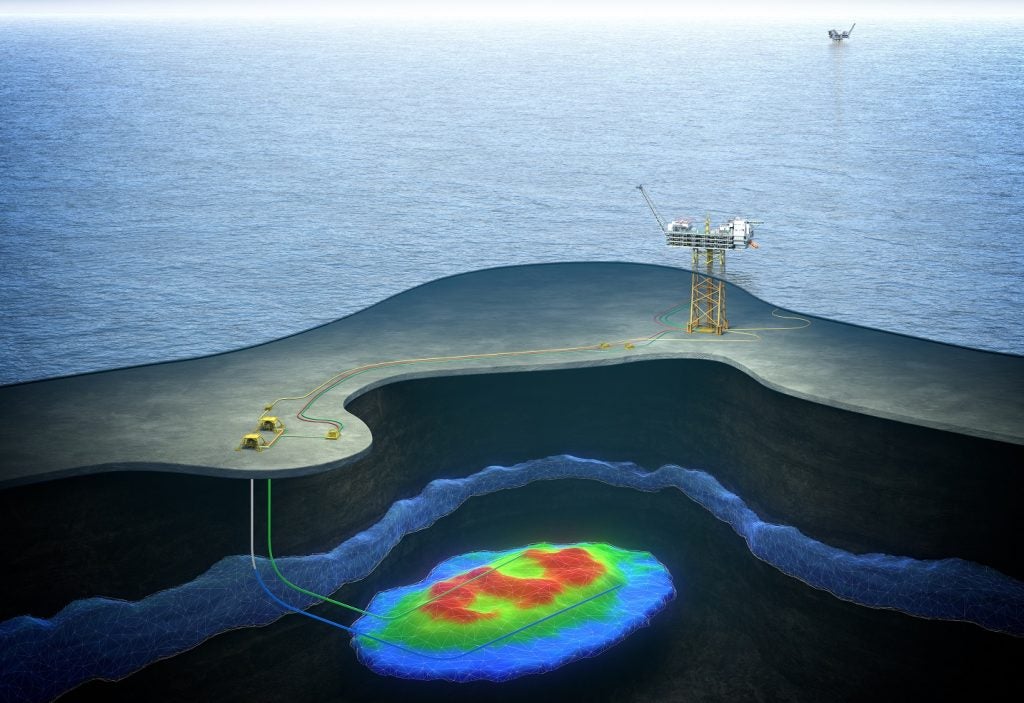

BP aims to lower exploration expenditure and postpone marginal projects in the upstream this year following the company’s fall in profits.

The move is expected to result in organic capital expenditure of around $20bn this year, significantly lower than the company’s earlier guide of $24bn to $26bn.

Chevron recently unveiled a 13% reduction in capital expenditure to $35bn.

See Also:

CMC Markets chief market analyst Michael Hewson was quoted by Reuters as saying the announcement of capital expenditure cuts and the reduction in rig counts by major oil companies are helping support prices.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe price of Brent crude has increased 11% in the previous two sessions following the sharp decline in the number of US oil drilling rigs.

However, two OPEC delegates have said there is a possibility that oil prices may decline to as low as $30 to $35 a barrel due to weak global demand combined with worldwide refinery maintenance in the first and second quarters of this year.