French oil and gas company Total has agreed to acquire 100% of the equity of Maersk Oil and Gas, a wholly owned subsidiary of AP Møller – Mærsk, for $7.45bn.

Under the terms of the acquisition, Total will pay AP Møller – Maersk a consideration of $4.95bn by issuing 97.5 million shares and assume $2.5bn of Maersk Oil’s debt.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Total chairman and CEO Patrick Pouyanne said: “This transaction delivers an exceptional opportunity for Total to acquire, via an equity transaction, a company with high-quality assets, which are an excellent fit with many of Total’s core regions.

“The combination of Maersk Oil’s North Western Europe businesses with our existing portfolio will position Total as the second operator in the North Sea with strong production profiles in the UK, Norway, and Denmark, thus increasing exposure to conventional assets in OECD countries.

“Internationally, in the US Gulf of Mexico, Algeria, East Africa, Kazakhstan, and Angola, there is an excellent fit between Total and Maersk Oil’s businesses, allowing for value accretion through commercial, operating and financial synergies.”

Subject to regulatory approval from relevant authorities, including the Danish Minister of Energy, Utilities and Climate and competition authorities, as well as legally required consultation and notification processes for employee representatives, the transaction is expected to close in the first quarter of next year.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataUpon completion, Total’s upstream businesses are expected to strengthen through the delivery of synergies and addition of growing assets.

Following the deal, Total will receive nearly one billion boe of 2P/2C reserves, about 80% of which are located in the North Sea.

Besides the addition of resources, the company expects to generate operational and commercial synergies of more than $400m annually.

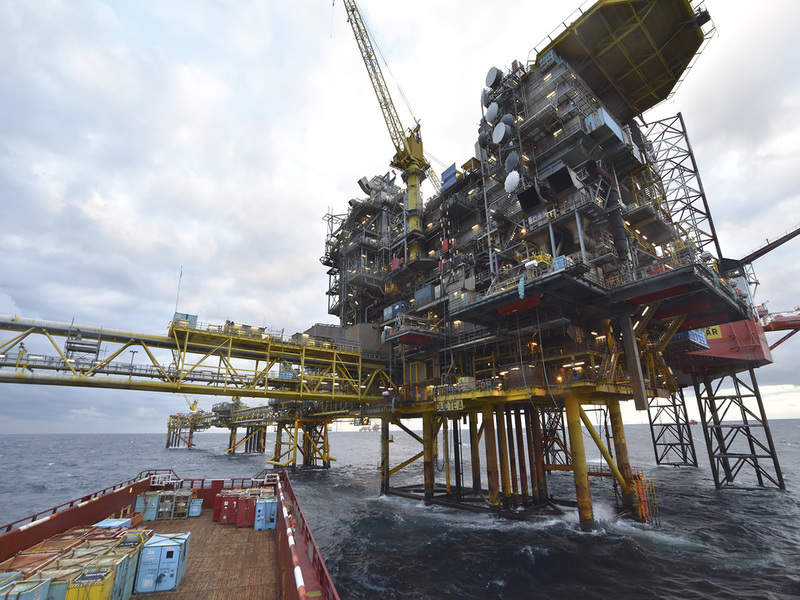

Image: Maersk Oil’s Tyra East field. Photo: courtesy of THE MAERSK GROUP.