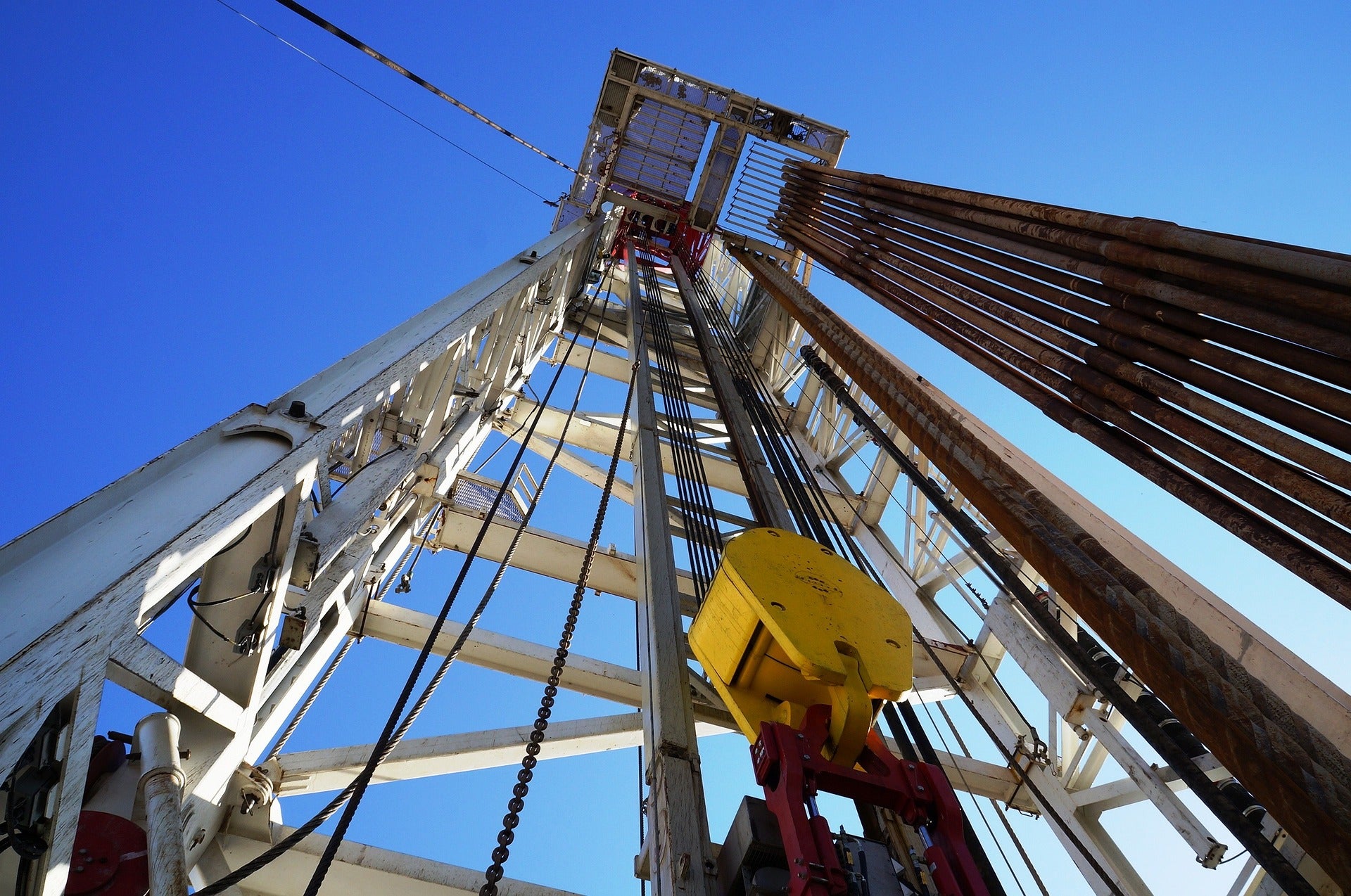

Northern Oil and Gas (NOG) has signed an agreement to purchase certain properties in the core of the Midland Basin in the US from Midland-Petro DC Partners (MPDC) for $330m.

Under the deal terms, NOG will acquire a 36.7% stake in the stacked pay, six-zone Mascot Project development project in the core of the Midland Basin.

The Mascot Project is operated by MPDC’s affiliate Permian Deep Rock Oil Company.

The acquisition includes 12.1 net producing wells, four drilling spacing units, 5.5 net wells-in-process, and approximately 17.3 net undeveloped locations, all located in Midland County, Texas.

NOG will also acquire a pro rata interest in the midstream assets and associated infrastructure.

NOG expects the properties considered for acquisition to produce an average of 4,400 barrels of oil equivalent per day (boepd) in the first quarter of next year and approximately 6,450 boepd for the full year 2023.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataA joint operating agreement has also been created by NOG and MPDC for the project. The firms plan to complete the drilling at the project in 2024.

NOG president Adam Dirlam said: “This acquisition has unique properties versus almost any prior transaction NOG has done.

“As typical, it is focused on one of the highest quality regions in the US, but what differentiates this transaction is the surety of development timing and returns, with a clear line of sight to turning valuable acreage into significant free cash flow, rapidly and efficiently.”

Earlier this month, NOG signed a deal to acquire certain non-operated interests in the northern part of the Delaware Basin, US, for $130m in cash.