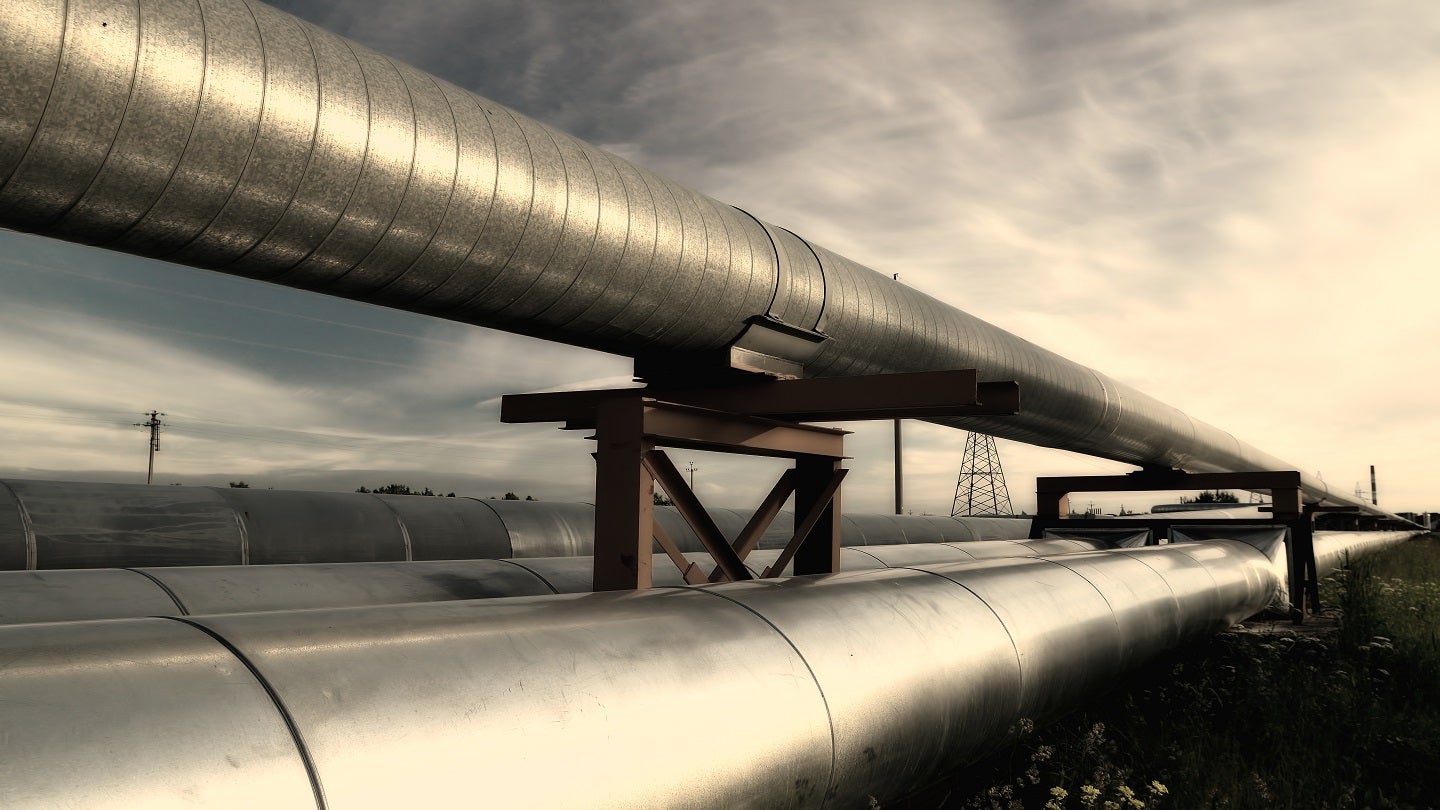

Oneok has reached an agreement to purchase American pipeline operator Magellan Midstream Partners in a cash-and-stock deal valued at approximately $18.8bn, including debt.

The deal marks natural gas-focused ONEOK’s foray into the transportation of refined products and oil.

The merger will create one of the US’ largest pipeline operators with a total enterprise value of $60bn.

As part of the agreement, each Magellan stockholder will get $25 in cash and 0.6670 shares of ONEOK stock.

The deal represents a premium of 22% based on Magellan shares’ closing price on 12 May 2023.

The deal includes $8.8bn in new equity and ONEOK taking on Magellan’s $5bn debt pile.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataONEOK president and CEO Pierce H Norton II said: “The combination of ONEOK and Magellan will create a diversified North American midstream infrastructure company with predominately fee-based earnings, a strong balance sheet, and significant financial flexibility focused on delivering essential energy products and services to our customers and continued strong returns to investors.”

The agreement will open up Magellan’s transportation business for refined goods and crude oil to ONEOK, which has previously only transported natural gas liquids and natural gas.

Norton added: “Our expanded products platform will present further opportunities in our core businesses, as well as enhance our ability to participate in the ongoing energy transformation with an increased presence in sustainable fuel and hydrogen corridors. We are excited about the future of our combined companies and look forward to welcoming Magellan’s well-respected employees to ONEOK.”

The deal is expected to be accretive to ONEOK’s earnings per share beginning in 2024 and is slated to conclude in the third quarter of 2023.

Magellan president and CEO Aaron Milford said: “Throughout more than 20 years as a publicly traded company, Magellan has remained focused on safe and responsible operations, financial discipline, and long-term investor value.

“We believe ONEOK shares these priorities, and we are pleased to join them in creating a stronger, more diversified midstream company.”