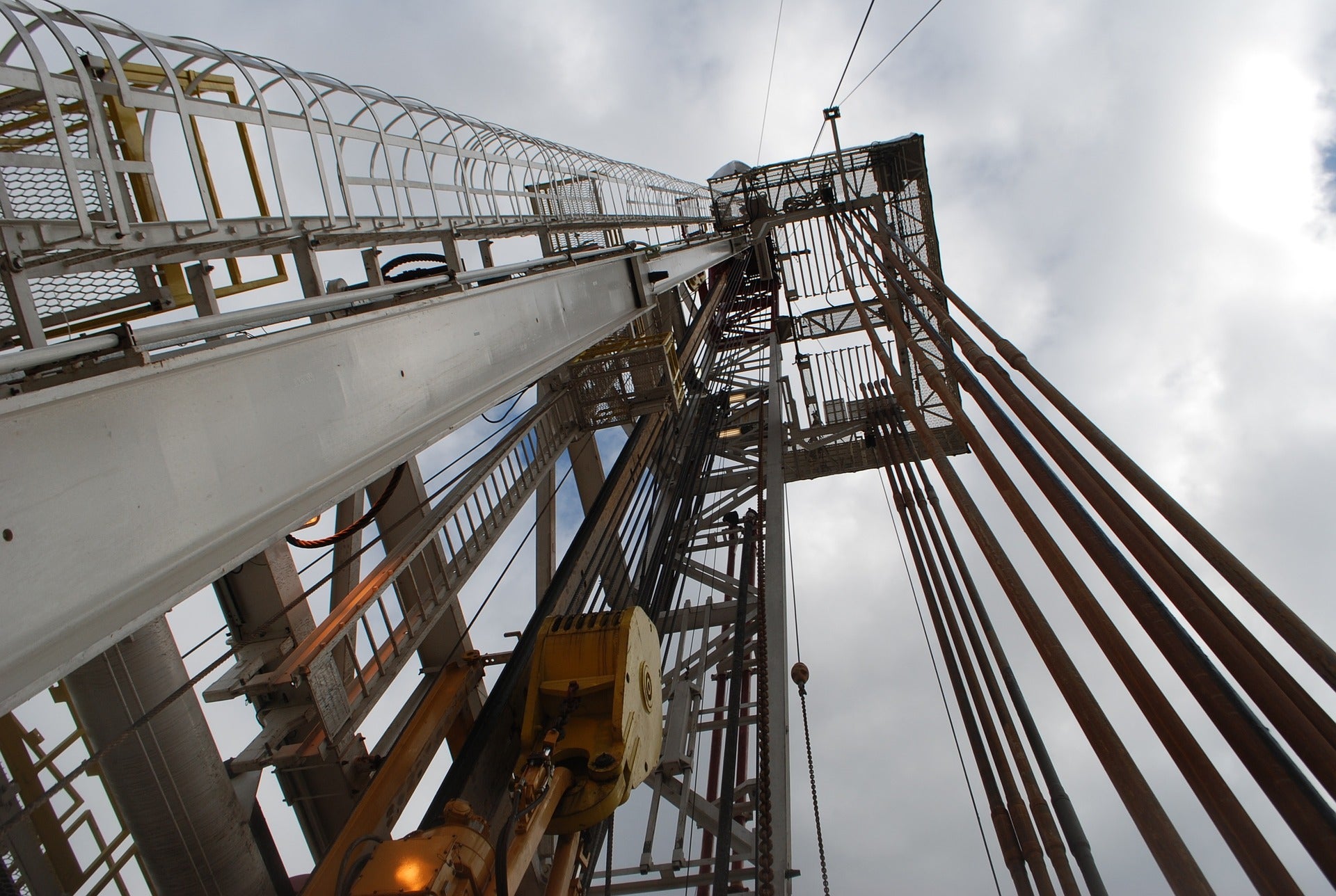

UK-based SDX Energy has started drilling the MSD-25 infill development well, on the Meseda field, in Egypt’s West Gharib concession.

The firm said that the MSD-25 well will target the Asl Formation reservoir, with a true vertical depth sub sea (TVDSS) of approximately 3,250ft.

SDX expects that it will take approximately six weeks to drill, complete, and tie-in the MSD-25 well to the existing infrastructure.

The well is estimated to have a gross production capacity of 300 barrels per day (bbl/d).

The well marks the second in the planned 12-well development drilling campaign, on the Meseda and Rabul oil fields, in the West Gharib concession.

See Also:

The first well, MSD-21, has already been tied-in, and has started production. It is expected to reach a gross production of 300 barrels per day in the next few weeks.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataSDX CEO Mark Reid said: “I am pleased that we have spud MSD-25, the second well in the campaign, so quickly after bringing MSD-21 onto production, which is testament to the efficiency of the operations team, and bodes well for completing the campaign in a timely manner.

“West Gharib is a very high margin asset in our portfolio, with a netback of US$35/bbl at US$68/bbl Brent, in the first nine months of 2021. Given this, it is our intention to execute this 12-well campaign as quickly as possible, and thus significantly boost production and cashflow from these fields.”

The campaign aims to grow production from the current gross rates of approximately 2,100bbl/d to 3,500 – 4,000bbl/d by early 2023.

According to the SDX Energy website, the company owns a 50% working interest in block H of the West Gharib concession. This block hosts the Meseda and Rabul fields.

Dublin International Petroleum is the other stakeholder.

In December last year, SDX reported a 4.23% increase in production in August 2021.