The automotive sector is undergoing a profound transformation of late, marked by fundamental shifts in vehicle technology, manufacturing processes, supply chains, business models, and workforce requirements. The most notable change is happening in its drive train, where the internal-combustion engine (ICE) is being replaced by electric powertrains, which consist of electric motors, batteries, and sophisticated power electronics. The sale of electric vehicles (EVs) is growing significantly as a share of new car sales globally, exceeding 20% worldwide in 2024 and projected to reach over 25% in 2025 as per the International Energy Agency (IEA). Government incentives, tax breaks, and strict emissions standards in various countries have been crucial in stimulating demand and encouraging manufacturers to produce more EV models. The continuous expansion of public charging networks is also helping alleviate the range anxiety and supporting long-distance travel, making EVs a more practical option for a wider audience. The transition is showing signs of reaching a tipping point in many regions, where market share gains are accelerating rapidly after crossing the 5% threshold.

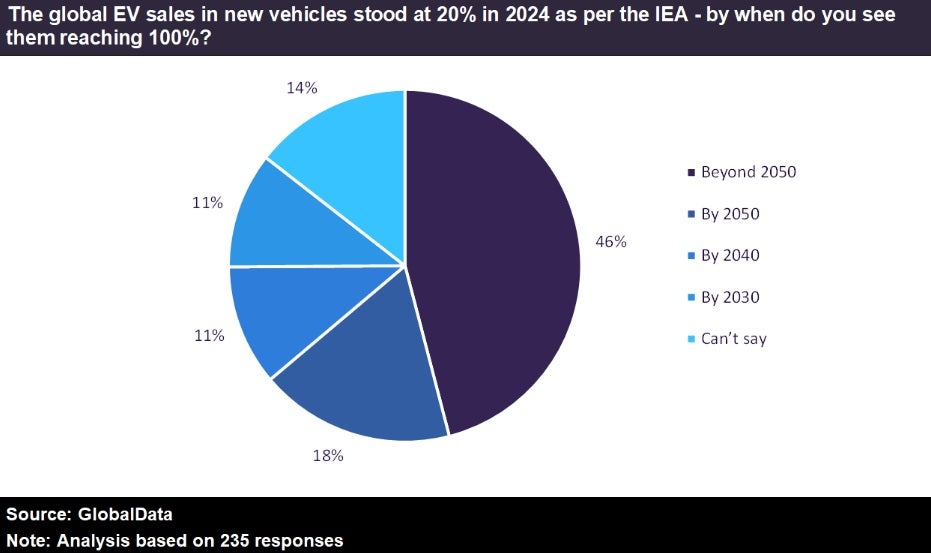

This rise of EVs could cause a structural decline in demand for traditional transportation fuels, both gasoline and diesel, potentially leading to a peak in global oil demand in the future. The objective of this GlobalData poll was to know by when could EVs completely take over the automotive sales, thereby putting a noticeable dent in fuel demand. The poll was answered by 235 respondents during September 2025. Nearly half of the respondents (46%) opined that EV sales would account for the entirety of total automotive sales at some point beyond 2050. The choice of this time limit might be based on both emotional and technical constraints associated with the automotive sector. Firstly, ICE vehicles are deeply ingrained in culture and lifestyles, and people might be reluctant to entirely do away with them. A significant portion of the global population, particularly apartment dwellers, lack access to dedicated overnight home charging, a key convenience for EV owners. Moreover, the existing electrical power grids in many regions are not yet equipped to handle the massive increase in demand that would result from mass EV adoption, requiring significant upgrades to generation and distribution systems.

A little under 40% of the respondents indicated that by 2050, almost all new vehicles sold would be electric. They might believe by this timeframe, the associated infrastructure would be ready to sustain an EV-only automotive industry. This would involve adequate charging points, both within residential areas and along transit routes along with power generation and grid modernisation to manage their energy demands. Besides, an industry assessment indicates that the overall energy demand for road transport increases only slightly with EVs despite a rise in total travel activity.

Around 11% of the survey respondents opined that 2040 could be the year when EVs would account for 100% of the new vehicle sales globally. This estimate might be based on policies in certain markets, such as European countries, have announced a complete ban on the sale of ICE-powered cars in the next decade, with deadlines varying from 2030 to 2035. If those deadlines are implemented strictly, then this estimate of EVs having 100% share might come true, at least in select markets.

Another set of respondents accounting for 11% of the total participants commented that by 2030, most new car buyers would opt only for EVs. This estimate sounds a bit too optimistic for most countries, but it might be feasible in relatively small markets with high EV penetration, such as Norway.

Lastly, around 14% of the respondents did not have the enough data visibility on the subject to give a definite timeline in the response. Additionally, countries heavily dependent on revenues from hydrocarbon exports might resist the switch entirely to EVs and might opt for a middle ground involving ICEs, EVs as well as hybrid vehicles. Such a scenario might make it impossible to predict the exact timeline for the complete transition of the automotive sector to EVs.