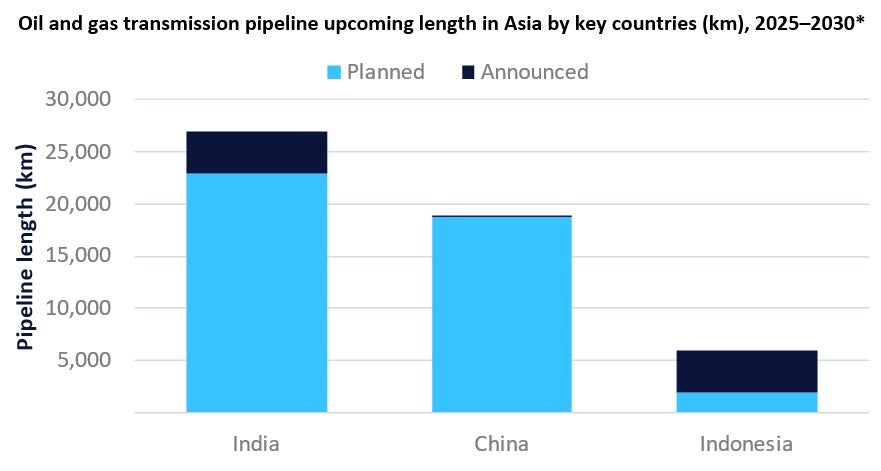

Asia is poised to dominate the global oil and gas trunk/transmission pipelines length additions, accounting for about 35% of the total upcoming length by 2030. This growth is underpinned by economic growth, surging energy demand, and ongoing industrialisation across countries such as India, China, and Indonesia. These nations are investing heavily in new pipeline infrastructure to secure energy supplies, diversify import routes, and support expanding urban populations.

India is set to dominate oil and gas pipeline length additions in Asia, accounting for over 40% of the region’s length additions by 2030. This can be attributed to several factors, including rising energy demand, the country’s focus on improving energy access, and support for industrial and urban growth. Furthermore, the country’s efforts to enhance energy security, reduce import bottlenecks, and meet ambitious targets for natural gas adoption are set to drive pipeline length additions.

Notably, projects that received all necessary approvals for development are set to account for over 85% of India’s upcoming pipeline length by 2030. Among these, the Kandla-Gorakhpur natural gas liquid pipeline is a major project that extends from Gujarat state to Uttar Pradesh state with a length of 2,800km. IHB is the operator while Indian Oil Corp (50.00%), Bharat Petroleum Corp (25.00%), and Oil and Natural Gas Corp (25.00%) are the equity holders in this onshore pipeline. Currently in the construction stage, the project is expected to commence operations this year. Other significant projects such as the Mehsana-Bhatinda gas pipeline and the Dhamra-Numaligarh oil pipeline further underscore India’s commitment to expanding its pipeline infrastructure during the outlook period.

China is expected to follow India in terms of pipeline length additions, accounting for nearly 36% of the total length additions in the region by 2030. Almost the entire upcoming projects in the country have received approvals for development and are gas pipelines. The Xinjiang-Guangdong-Zhejiang synthetic natural gas (SNG) pipeline is a major upcoming project with a length of 8,972km. SNG Transmission Pipeline is the operator while China National Petroleum (29.90%) and China Petrochemical (14.00%) are the major equity holders of the project, which is set to begin operations next year. The West-East IV gas pipeline and the Zhongwei-Ji gas pipeline are some other major projects with significant length additions during the outlook period.

Indonesia stands third in terms of upcoming pipeline length, with nearly 5,889km of length expected to be added by 2030. Announced pipelines’ length is likely to account for two-thirds of the upcoming length in the country. Among these, the West Kalimantan-Central Kalimantan gas pipeline is a major pipeline with a length of 1,800km and is expected to commence operations in 2028. PT Pertamina has the entire equity stake while PT Perusahaan Gas Negara is the operator. Further analysis on global oil and gas pipeline projects can be found in GlobalData’s new report, Oil and Gas Pipelines Industry Outlook by Length and Capital Expenditure Including Details of All Operating and Planned Pipelines to 2030.