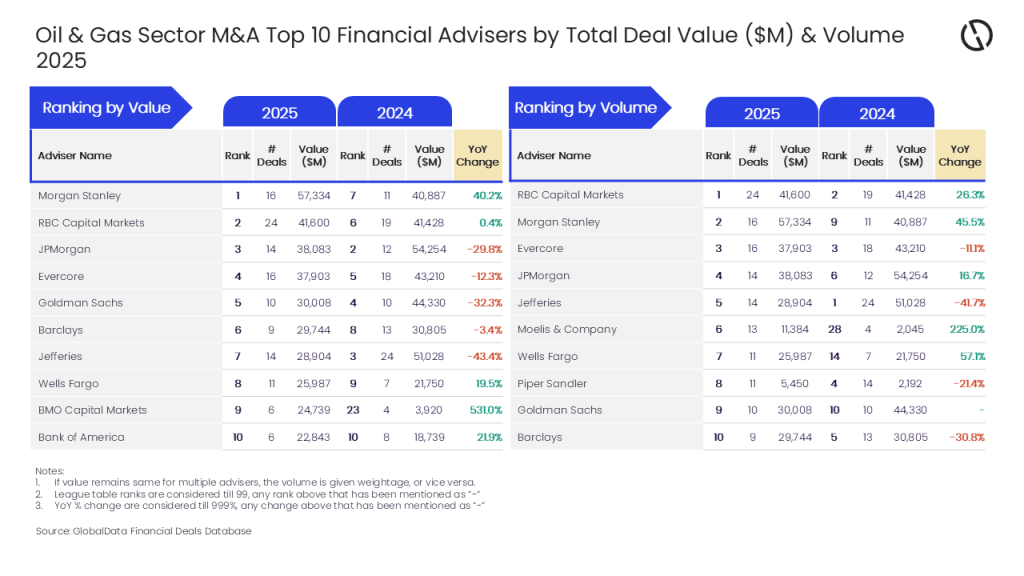

Morgan Stanley and RBC Capital Markets were the leading financial advisers for oil and gas sector mergers and acquisitions (M&A) in 2025, based on a league table from data analytics company GlobalData.

According to GlobalData, Morgan Stanley achieved the top ranking by deal value, advising on transactions totalling $57.3bn. RBC Capital Markets distinguished itself in terms of volume, with advisory roles in 24 separate deals.

Data from GlobalData's Financial Deals Database highlights that JPMorgan secured the third position by value, facilitating deals worth $38.1bn. Evercore followed closely with transactions amounting to $37.9bn, while Goldman Sachs advised on deals valued at $30bn during the same period.

In terms of deal count, Evercore also emerged as a prominent adviser, taking third place with 16 deals. JPMorgan and Jefferies completed the ranking, each advising on 14 transactions. The analysis focused exclusively on deals valued at $1bn or more.

GlobalData lead analyst Aurojyoti Bose said: “RBC Capital Markets not only led by volume but also advised on several big-ticket deals during 2025, which helped it secure the second position by value as well, having advised on $41.6bn worth of deals. During the year, RBC Capital Markets advised on 13 billion-dollar deals.

“Meanwhile, Morgan Stanley advised on ten billion-dollar deals that also included two megadeals valued at more than $10bn. In fact, it was the only adviser to surpass the $50bn-mark during 2025. The global financial services firm also held the second position by volume with 16 deals.”

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available in the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.