The Ande Ande Lumut (AAL) oil project is the biggest undeveloped oil field in the Northwest Natuna Sea, Indonesia. Lying in water depths of 73m, the project is jointly owned by Santos (50%) and AWE (50%), with the former serving as the operator.

Santos is currently carrying out the pre-front end engineering and design for the project. The existing low oil price environment is expected to help in achieving significant cost savings for the project.

First oil from the field is expected in 2020.

Ande Ande oil project geology and reserves

The AAL project is estimated to contain gross proved and probable reserves of 101 million barrels of gross recoverable oil in the K-sand reservoir. The underlying G-Sand reservoir is estimated to hold 289 million barrels of gross oil in place with 36 million barrels of gross recoverable oil.

Drilling and appraisal at Ande Ande

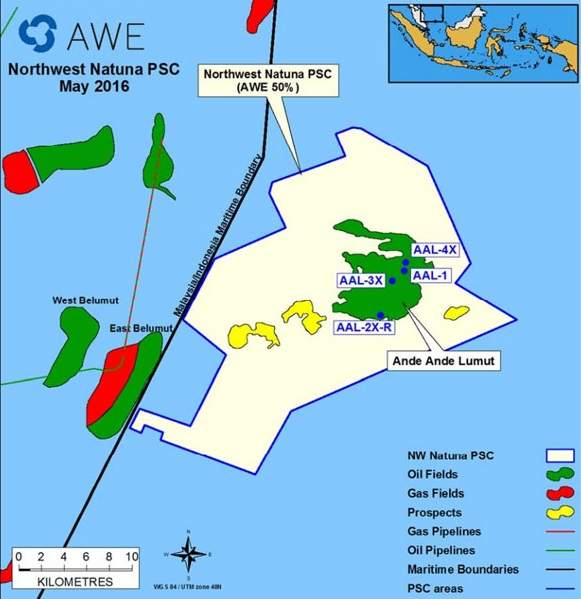

AAL was discovered by Premier Oil in 2000 by the AAL-1 exploration well. The field was later acquired by the Malaysian oil and gas company Genting Berhad. The company drilled three additional vertical wells, AAL-2, AAL-2X-R and AAL-3X, to appraise the field.

AAL-2X-R was drilled to a depth of 1,356m and encountered a 9m oil column in a 44m-thick K-Sand reservoir. The AAL-3X well was drilled to a depth of 1,290m and intersected multiple oil-bearing sandstones.

A comprehensive testing programme was conducted on two of the sandstone reservoirs to test the flow rate of oil to the surface. The first flow test was conducted on an 8m sandstone reservoir, which produced oil at a rate of 525 barrels of oil a day (bopd). The second flow test was conducted on the upper part of the K Sand reservoir, which produced at the rate of 1,210bopd.

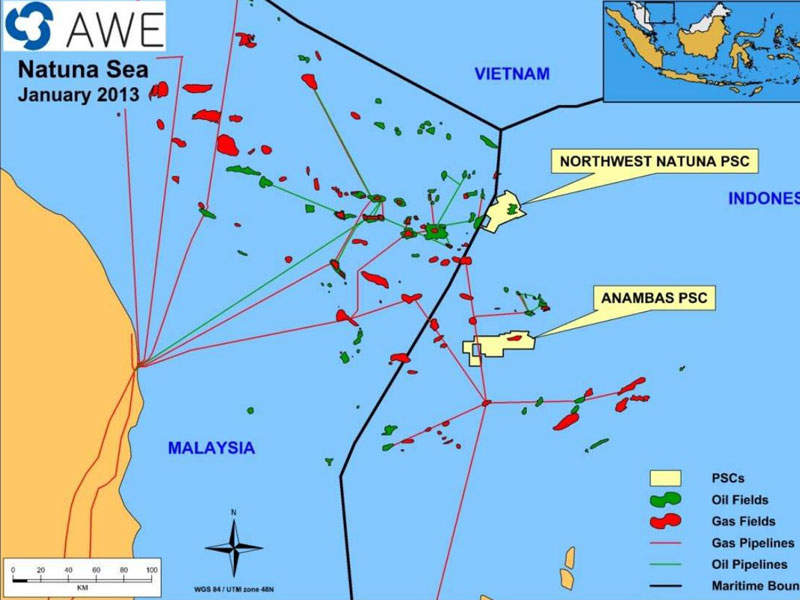

Genting sold its 100% stake in the Northwest Natuna Production Sharing Contract (PSC) containing the AAL project to AWE transferring complete ownership to the company in early-2012. AWE then evaluated the 3D seismic data, well logs and flow test results to develop a comprehensive reservoir simulation model.

AWE sold a 50% stake in the PSC to Santos in November 2013, in addition to transferring operatorship to develop the field.

In May 2016, Santos successfully spud the AAL-4X appraisal well targeted at the G-sand reservoir. The well was drilled to further appraise the G-sand reservoir to enable the preparation of a plan of development (POD) for the G-sand reservoir and its development in conjunction with the K-sand reservoir. The POD for the K-sand reservoir has already been approved by the Indonesian government.

The AAL-4X well was drilled to a depth of 1,232m by the Raniworo jack-up drilling rig. In June 2016, a successful drill stem test was completed on the well, which achieved a flow rate of 828bopd. Bulk oil samples recovered from the well site indicated the G-sand oil to have a specific gravity of 10.7 API at 60° F, similar to the previous samples from AAL-3X.

A second drill stem test was conducted on the ALL-4XST1 appraisal well, which achieved a flow rate of 1,120bopd. Testing of oil samples collected from the AAL-4XST1 appraisal well indicated lower levels of impurities and better quality of crude oil. The results indicate improved project economics and reduced capital expenditure for the developers.

Ande Ande oil field development details

The AAL field is planned to be developed through 33 horizontal wells drilled in the K-Sand reservoir. The wells will be connected to a well head platform (WHP) and a permanently floating production, storage and offloading (FPSO) vessel, which will offload oil by shuttle tankers.

The WHP will be linked to the FPSO through a telescopic bridge with all the wells being connected through flexible pipelines and cables. Electrical submersible pumps will transfer the produced oil to the FPSO for processing. The WHP will include facilities such as electrical switchgear and switch room.

The developers are planning to tender the contracts for the WHP and FPSO vessel in early-2017 before taking the final investment decision in the second half of 2017.

Contractors involved

NauticAWT Energy Solutions was involved in the appraisal well completion and design of the four vertical wells drilled in the K-sand reservoir.

Synergy Engineering performed the front-end design and engineering for the WHP.