Bayan oil and gas field is located in sub-block 4Q-21 of the Balingian Province at a water depth of 28m, approximately 80km north-west of Bintulu, offshore Sarawak, Malaysia. It is operated by Halliburton Bayan Petroleum, which is jointly-owned by Dialog D & P (95% stake), a wholly owned subsidiary of Malaysia’s Dialog, and Asia Energy Services (5%), a wholly owned subsidiary of Halliburton International.

Dialog D & P agreed to acquire an additional 20% equity interest in Halliburton Bayan Petroleum in December 2019 after it purchased a 25% interest in August the same year.

In November 2012, the companies collaborated to jointly manage a $1.2bn oilfield services contract (OSC) of Bayan field through Halliburton Bayan Petroleum up to 2036 to boost production from the existing fields. Halliburton Bayan Petroleum also partnered with Petronas Carigali to enhance the recoverable reserves in the Bayan field. Activities related to production enhancement and studies for further development of the field have been ongoing since 2015.

Bayan field location

The Bayan field is one of the four marginal oil and gas fields that form the Balai Cluster. It is bounded by the D18 field on the north-east side and Temana field on the south-east side.

Production from the D18 mature field is exported to the Bintulu crude oil terminal via the Bayan and Temana platforms.

Bayan field discovery and appraisal details

Bayan field is a tectonically complex formation, discovered by the exploratory well BY-l in 1976. The productive reservoirs in the field contain deposits in lower coastal plain to delta plain of the early Miocene era. S3.8 was a major reservoir in the middle Miocene formations.

The oil and gas field was initially developed with four development wells in block one of S3.8 reservoir in 1984 and later five additional development wells in block four.

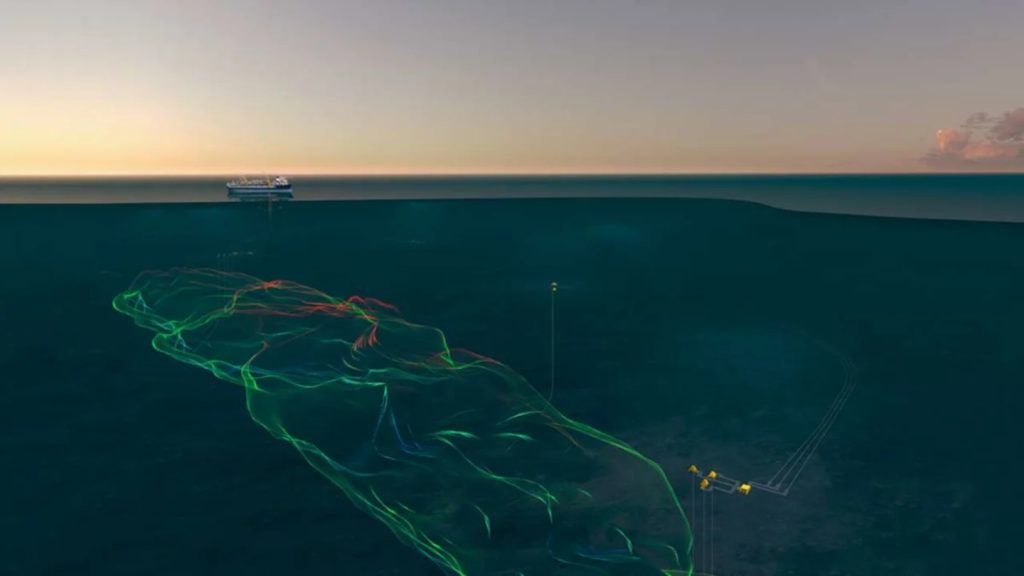

The first drilling platform, BYDP-A, was installed at the field and the 3D seismic data from the field was collected in 1986.

The field is divided into various faulty blocks and 13 appraisal wells were drilled to analyse the prospects of the faulty blocks. Two infill wells were drilled from new well slots in the BYDP-B platform.

Horizontal wells optimised the oil recovery from thin oil rim reservoirs.

Bayan field redevelopment project phase two development details

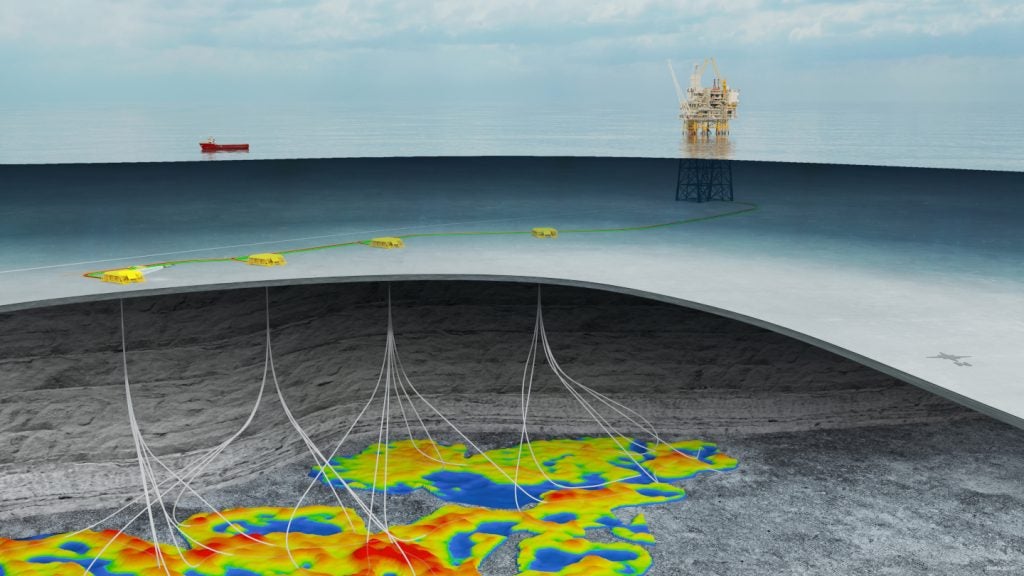

Bayan is a producing oil field that is being further developed under brownfield Bayan gas redevelopment project phase two, using a new-built floating mobile offshore production unit (MOPU) to enable gas separation and processing. The produced gas will be exported to liquefied natural gas producers in Malaysia.

The MOPU will be connected to the existing BYR-A riser platform in the Bayan field via a new 12.7km-long pipeline between the BYDP-C and BYR-A platforms. It will have a processing capacity of approximately 100 million cubic feet per day of gas.

Drilling of four new wells from the BYDP-C platform and upgrade of the existing infrastructure will also take place in phase two of the project.

Oil and gas from the field are transported to the Bintulu crude oil terminal, while produced gas is marketed to the domestic market and utilised as feedstock at the gas-to-liquids (GTL) plant of Shell.

Contractors involved

Petronas awarded a ten-year contract to Tanjung Offshore Services, a wholly owned subsidiary of T7 Global, and its consortium partner VME Process Systems Malaysia for the lease, operation and maintenance of the MOPU for the Bayan gas redevelopment project phase two. Effective from February 2020, the contract includes the complete engineering, procurement, construction, installation and commissioning (EPCIC) works for the MOPU, as well as operation and maintenance services. Tanjung Offshore Services and VME Process Systems will also be responsible for the demobilisation and decommissioning of the MOPU.

Skrine was the advisor to Halliburton for a transaction regarding the disposal of a 25% stake to Dialog D & P in Halliburton Bayan Petroleum in August 2019.