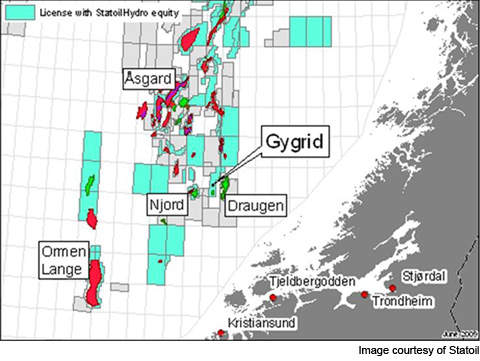

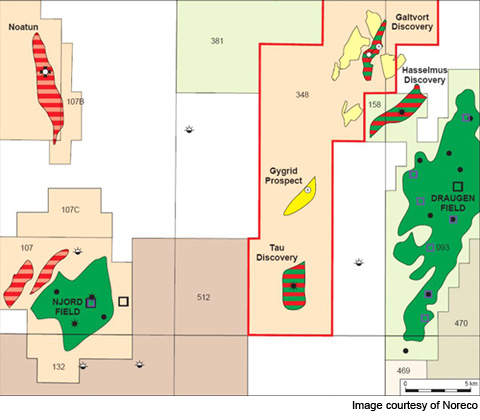

The Gygrid prospect is a light oil field situated at a water depth of 810ft in North Sea, Norway. The field lies in block 6407/8 of the production license 348.

Statoil is the operator of the field and has 35% interest. Other licensees include GDF Suez (20%), Norwegian Energy Company (17.5%), E.ON Ruhrgas (17.5%), Petoro (7.5%) and VNG Norge (2.5%).

The partners are expected to submit a plan for development (PDO) of Gygrid to the Norwegian government in mid-2011. The field is expected to come on stream in late 2012 or early 2013 with a plateau production of 15,000 barrels of oil equivalent per day (boe/d). An investment of NOK4bn ($0.7bn) is expected to be made in the development.

Discovery

The Gygrid prospect was discovered in June 2009 by the 6407/8-5 S exploration well. The well was drilled to a depth of 7,700ft. An appraisal well 6407/8-5 A drilled as a sidetrack to a depth of 6,965ft confirmed presence of oil at the field. The two wells were not formation tested but extensive data and cores were collected. They were later permanently plugged and abandoned.

The discovery was made along with two other fields, Galtvort and Tau, in the same production license. The area is estimated to contain several other potential prospects, which are currently being explored by the partners. Seismic studies are ongoing to explore the resource potential in the area.

Geology and reserves

The Gygrid field reservoir is made of Tilje and Ile formations of the Lower Jurassic age. The exploration well found oil in the Tilje formation and the sidetracked well confirmed oil in the Ile formation.

The field was initially estimated to contain three to 5 million cubic metres of recoverable oil. The estimates were later upgraded to 20 to 30 million barrels of recoverable oil. Additional reserves are expected to be contained in the Ile formation.

Field development

Statoil contracted Seadrill’s West Alpha semi submersible rig in February 2009 to carry out drilling activities at the field. The rig drilled four wells in the production license, including the exploration and appraisal wells at the Gygrid prospect in 247m of water.

In February 2010 the field was put on fast track development which includes a subsea template consisting of one production well and an injection well. Fast track development was chosen to maintain Statoil’s current oil and gas production levels in the North Sea.

The Gygrid prospect will be produced as a subsea tie back to the Njord A platform situated 20km west of the field. Statoil explored the possibility of developing Gygrid as a tie back to the Draugen or Njord A installations. In November 2010, the company announced its decision to develop the field as a tie back to the Njord field.

The tie back will enable Statoil to extend the life of the aging Njord field, which will cease production in 2015, by another two years.

The tie back option was also considered to be most technically and financially feasible solution for the company as it would allow the use of the spare capacity on the Njord platform.

Njord A platform

The Njord A platform is a floating steel production facility installed at a depth of 1,089ft. It was purpose built for the Njord field and has been producing since 1997. It features an integrated deck with drilling, processing and accommodation facilities.

The platform will be modified to accept oil and gas from the Gygrid field.

Contracts

In January 2011, FMC Technologies won a $54m contract to provide subsea equipment for the field.

FMC will supply two subsea production trees, one manifold and related control systems. Deliveries are expected to commence in the third quarter of 2011.