The North El Amriya and North Idku (NEA/NI) concession subsea tieback project involves the development of satellite gas fields in the NEA and NI concessions located near Abu Qir gas fields in the Mediterranean Sea, offshore Western Nile Delta, Egypt.

The NEA/NI concessions are owned by Energean and managed by Abu Qir Petroleum. Energean added the NEA/NI concessions to its portfolio along with the producing Abu Qir gas fields through the acquisition of Edison E&P in December 2020.

The gas fields of the concessions will be developed at the water depths of 30m to 85m with an estimated total investment of approximately $235m.

The final investment decision (FID) for the development of the NEA/NI concession subsea tieback project was made by Energean in January 2021. The project is expected to produce first gas in the second half of 2022.

North El Amriya and North Idku geology and reserves

The NEA concession contains two fields Python and Yazzi, which were discovered in 2011. The Yazzi field will produce hydrocarbons from the Abu Madi formation, while Python will produce gas and condensate from the Kafr El Sheikh formation.

The NI concession includes four discovered gas fields, of which one is ready for the development.

NEA/NI is estimated to hold 49 million barrels of oil equivalent (mmboe) of proved and probable (2P) reserves, with gas reserves accounting for 87% of the reserves. The peak production from the fields is estimated to be approximately 90 million cubic square feet of gas per day (mmscf/d) and one thousand barrels of oil per day (kbopd) of condensates.

North El Amriya and North Idku subsea tieback project details

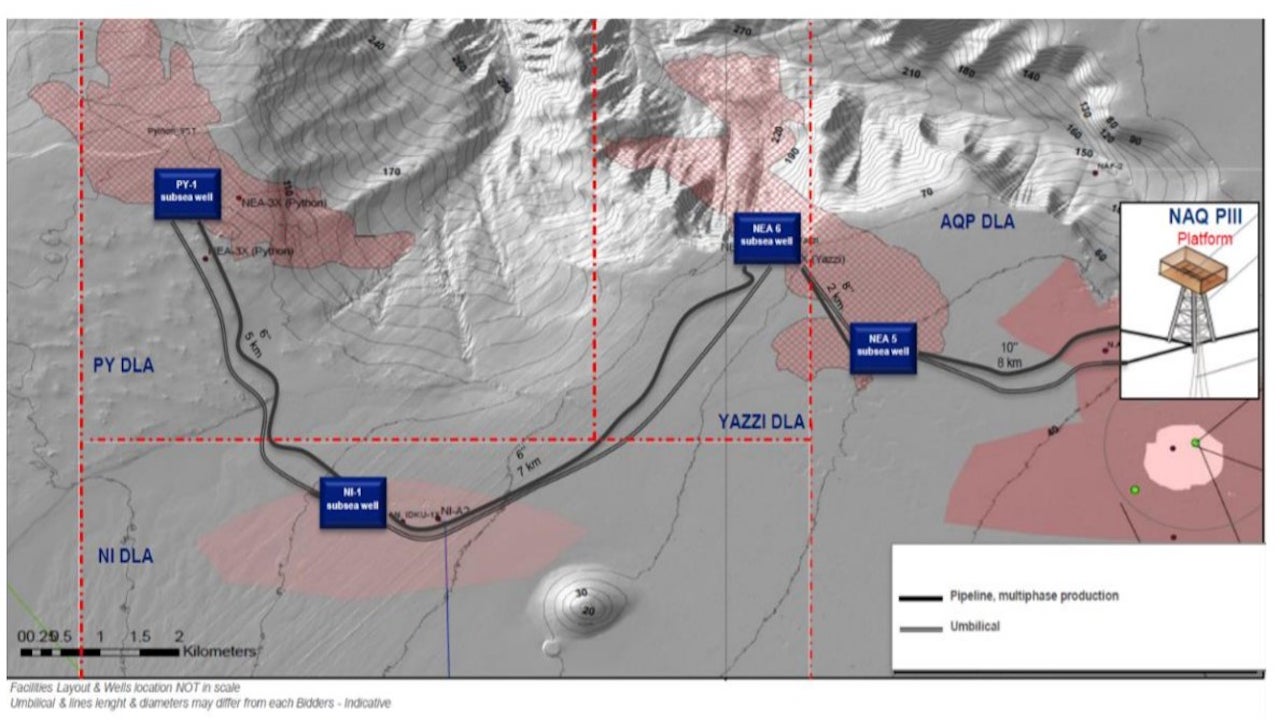

NEA/NI will be developed with three subsea wells, which will be tied back to the existing North Abu Qir III platform of the Abu Qir gas-condensate offshore infrastructure.

Additionally, a fourth well will be drilled for the development of the NI-1 discovery and tied back to the NEA.

The NEA/NI drilling campaign is anticipated to be integrated with the larger Abu Qir drilling campaign to increase the cost efficiency and strategic benefits of the project.

The produced gas will be transported to the Abu Qir onshore receiving gas terminal where it will be treated and supplied to the market via pipelines.

Abu Qir fields details

Located at water depths between 14m and 35m, Abu Qir is the oldest gas production area in the Mediterranean Sea.

Abu Qir complex comprises three gas fields, namely Abu Qir, North Abu Qir and West Abu Qir, as well as six production platforms interconnected by pipelines, making it one of the largest gas-producing hubs in Egypt.

The Abu Qir field was discovered in 1969 and the field came online in 1979. The total concession contains 88mmboe of 2P reserves and had an average production of 48.1 thousand barrels of oil equivalent per day (kboepd) in the nine months to September 2020.

Contractors involved

TechnipFMC received the engineering, procurement, installation and commissioning (EPIC) contract for the development of the NEA/NI concession subsea tieback project.

Oil and gas operations of Energean

With the acquisition of Edison E&P, Energean entered oil and gas operations in Egypt. The company has its operational footprint in Israel, Italy, Greece, UK, Croatia, Montenegro, Cyprus and Malta across the Mediterranean Sea and UK North Sea.

The main production of the company comes from the Abu Qir fields, as well as fields in Italy, Croatia and the UK.

The Karish North and Karish and Tanin gas field developments in the Mediterranean Sea, offshore Israel, are Energean’s flagship projects that are expected to increase the company’s production capacity to 130,000boe/d upon commissioning in the fourth quarter of 2021.

The company markets 70% of its production and secures the future revenues from the volatility of oil prices through the long-term gas supply agreements.