Serrano and Oregano are Shell’s 14th and 15th deepwater projects in the Gulf of Mexico respectively.

Although Serrano and Oregano are separate fields, the development activities are being executed through a single, integrated plan.

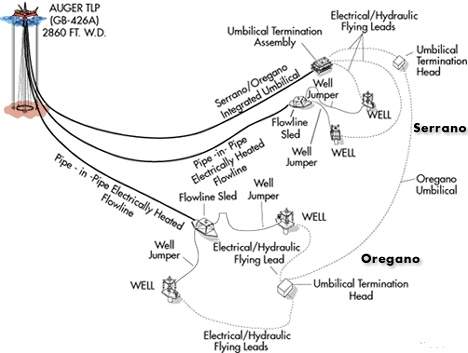

The fields are located in 3,400ft of water and are produced via a subsea production system tied back to the Auger tension leg platform, which lies in 2,400ft of water.

Shell estimates that each field will recover about 50 million barrels of oil equivalent (boe), primarily gas from Serrano and oil from Oregano.

Development costs for the two projects are $250 million, excluding lease costs.

Serrano

Serrano is located in Garden Banks (GB) blocks 516 and 472 in the Gulf of Mexico, approximately 220 miles south-west of New Orleans, in approximately 3,400ft of water.

The GB 516 lease was acquired in the OCS sale 104 in 1985, while the GB 472 lease was acquired in 1989 in OCS lease sale 123. The leases are owned 100% by Shell Deepwater.

The discovery well was drilled on GB 516 in 1996, using the Ocean Worker. This was followed by a discovery on GB 472 in 1999 using the Transocean Marianas.

The target reserves are in the SE 40 and SE 55 sands at depths of approximately 12,000ft and 18,000ft subsea respectively.

The average net pay is approximately 80ft and 110ft, respectively. The reserves are gas and associated gas condensate.

Total gross ultimate recovery is estimated to be at about 50 million barrels of oil equivalent.

Peak production is expected to be 160 million cubic feet of gas per day. Development began in December 2001.

Serrano’s wells are producing 52.5 million cubic feet of gas per day and 4,625 barrels of oil per day (bopd), with peak production rates increasing to 150 million standard cubic feet per day (Mmcfd) by 2003 as gas-handling capacity at Auger becomes available.

Total development costs for Serrano are approximately $120 million, excluding lease costs.

Oregano

Oregano is located in Garden Banks (GB) block 558 and 559 in the Gulf of Mexico, about 225 miles south-west of New Orleans in approximately 3,400ft of water.

The GB 559 lease was acquired in the OCS sale 123 in 1989 for $177,000. The GB 558 lease was also acquired in 1989 in the OCS lease sale 123 for $162,000.

The leases are 100% owned by Shell Deepwater.

The discovery well was drilled on GB 559 in 1999 using the Noble Paul Romano. The target reserves are in the K sands at a depth of approximately 19,000ft subsea.

The reserves are oil and associated gas. API gravity for the oil is 35-37.

Sulphur content is approximately 1.08%. The total gross ultimate recovery is estimated at about 50 million boe.

Oilfield development

In August 2000, Shell announced plans to develop Oregano utilising a subsea system, tied back eight miles to the Auger TLP on Garden Banks block 426.

Production began in October 2001 at a rate of 11,000bpd through a subsea production system.

Peak production rates are expected to reach 20,000bpd.

The subsea system consists of two wells connected to a flowline sled that is tied back to Auger via a single 6in x 10in pipe-in-pipe insulated flowline.

Electrically heated lines eliminate the need for two separate flowlines that are usually required for pigging, as well as the need for injecting methanol to control hydrates and wax.

An AC current will heat the flow lines to about 85°F during flow shut-in periods and to 130°F during longer shut-in periods.

Shell will save about $17m in capital and operating expenses. A non-metallic composite insulation is to be used between the pipe-in-pipe flowlines.