The upstream sector reported 205 awarded contracts in June 2017. Among the notable contracts in the upstream sector were: JGC and its subsidiary, JGC Algeria’s contract worth approximately $636.65m from Sonatrach for Engineering, Procurement, Construction and Commissioning (EPCC) for a gathering and processing facility in the Hassi Messaoud field area of Algeria, and Monadelphous Group’s five-year contract worth approximately $455.68m from Woodside Energy for the asset general maintenance services and offshore implementation for Woodside-operated gas production facilities in the north west of Western Australia.

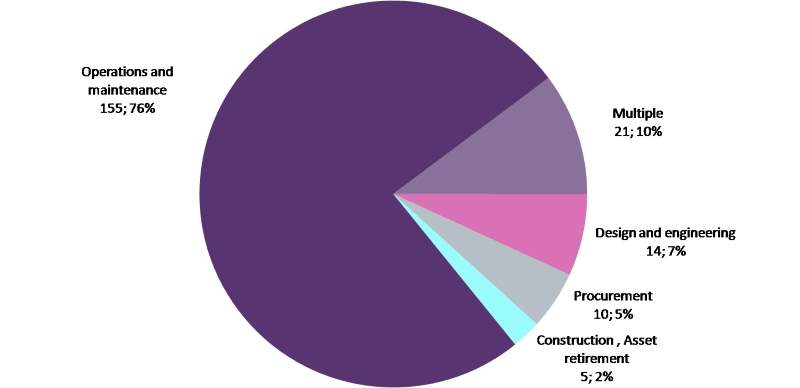

Operation & Maintenance (O&M) accounted for 76% of the awarded upstream contracts. There were contracts for the provision of ultra-deepwater drillship; jack-up and semi-submersible rigs; Offshore Support Vessels; Diving Support Vessel; Anchor Handling Tug Supply (AHTS) vessels; Remotely Operated Vehicle (ROV) services to support offshore operations; well completion, drilling, and well technology services.

Upstream contracts by scope and count, June 2017

Source: GlobalData Equipment and Services Analytics

Design and engineering accounted for 7% of the awarded upstream contracts, with activities focused on the provision of 3D electromagnetic data, 4D seismic data acquisition, and a wide range of environmental consultancy services.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataContracts with multiple scopes, such as construction, design and engineering, installation, O&M, and procurement, accounted for 10% of the contracts awarded in the upstream sector in June 2017. There were contracts for the provision of engineering, procurement, fabrication, installation, commissioning, and hook-up of wells; Engineering, Procurement, Construction, Installation and Commissioning (EPCIC) of wellhead platforms and services for an Improved Oil Recovery (IOR) project.

Procurement accounted for a mere 5% of the awarded upstream contracts, including the supply of High-Pressure/High-Temperature (HPHT) surface wellhead systems, valves and piping equipment.