The ongoing Ukraine-Russia conflict, which broke out in February 2022, has widely impacted global energy supply chains, resulting in a spike in inflation.

This conflict also exposed the economic frailty of the European countries, which were strongly dependent on Russian energy exports.

The West faulted Russia for unilaterally invading parts of Ukraine and imposed wide-ranging sanctions on Russian organisations.

In December 2022, the EU banned the purchase, import, and transfer of seaborne crude oil from Russia. The ban was further extended to refined petroleum products in February 2023.

This weighed on Russia’s finances as oil and gas constitute a major share of exports from the country. However, the full economic impact of these sanctions on Russia is still unclear.

See Also:

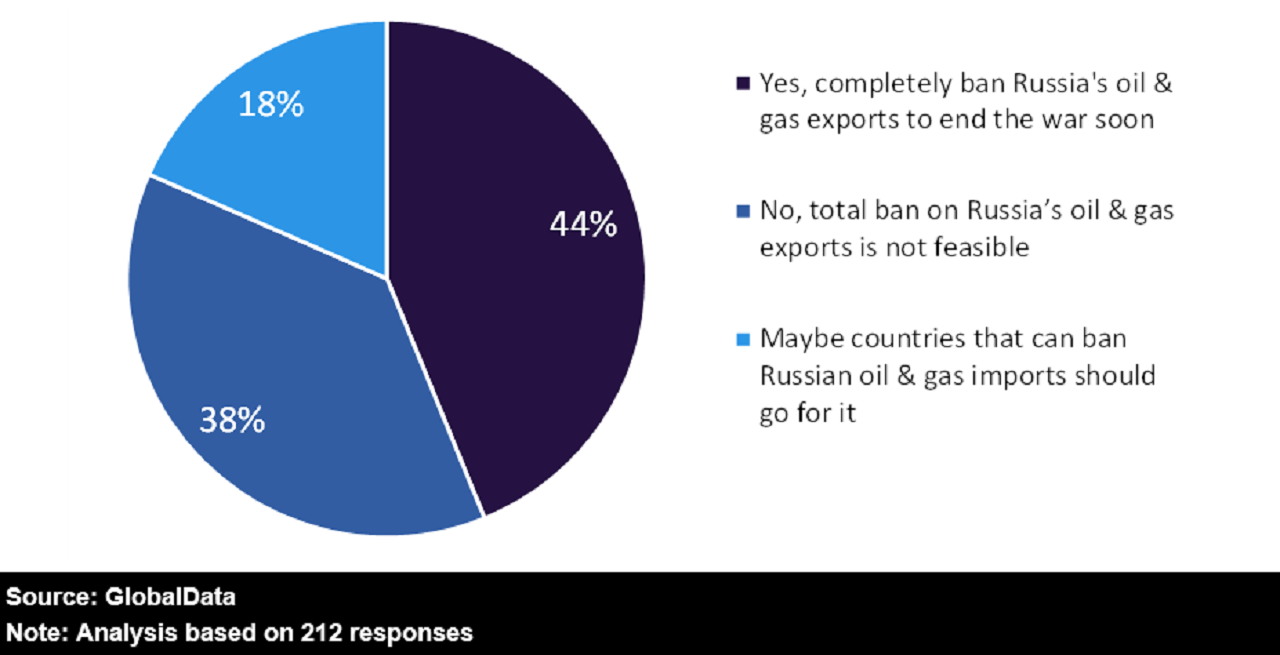

In November-December 2023, GlobalData, a leading data and analytics company, conducted a poll to gauge the opinion of industry leaders on whether the rest of the world should take Europe’s cue and ban Russian oil and gas exports to hamper its finances.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataApproximately 44% of respondents agreed with this view and opined that banning Russian oil and gas exports would lead to a sooner end to the war.

This reasoning stems from the logic of cutting off war funding for Russia. Attacking Russian oil and gas exports, which amount to around one-sixth of its gross domestic product, seems a quick-fix solution in this regard.

About 38% of respondents, slightly less than the previous set, took a contrary stand. They opined that such a ban is not feasible as the world still heavily depends on oil and gas, and Russia is a key supplier.

Cutting off oil and gas supply from Russia is bound to have a far-reaching impact on several industries, especially in Europe and Asia.

Such a move would naturally lead to a spike in oil prices, creating a burden predominantly on energy-deficient nations.

Several countries have been reeling from high inflation since the start of the Russia-Ukraine conflict and would not prefer additional price hikes for basic commodities.

European energy transition efforts have also hit a snag, and fears of energy shortages have caused a flurry of activity in the liquified natural gas segment.

Given such a tumultuous scenario, it can be reasoned that banning Russian energy exports might not be economically feasible for most countries around the world.

Heeding to the imbalance in the distribution of energy sources among countries, roughly 18% of respondents felt that maybe the countries that are in the position to enforce and sustain such a ban should do so.

This is a pragmatic standpoint that can be extrapolated to infer those countries dependent on Russian energy exports could continue doing so until they find suitable alternatives.

This viewpoint acknowledges the sociopolitical and humanitarian disaster caused by the Ukraine conflict but is also considerate of the energy demands of the countries whose economy is strongly dependent on fossil fuels.