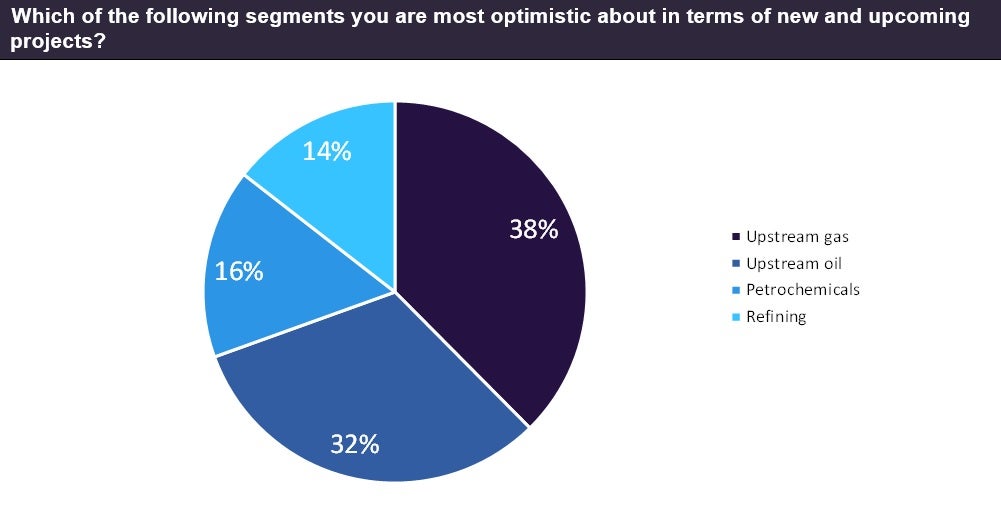

The oil and gas industry outlook is hinged on energy demand patterns that could see alterations with the ongoing efforts for global energy transition. When the outlook is positive, it is reflected through investments in new projects. During April-May 2023, GlobalData conducted a poll among industry players asking about the most promising oil and gas segment for investing in new and upcoming projects. Around 38% of the respondents opined that the upstream gas segment was the most promising of the oil and gas segments. There is a strong demand for natural gas in Europe and Asian markets. Growing natural gas demand in these regions is mainly due to a conscious shift away from emission-intensive coal in power generation. Also, booming consumption in Asian economies is driving gas demand in commercial and residential applications. Besides, key markets around the world are pushing for hydrogen usage in industrial applications to mitigate carbon emissions. Presently, hydrogen is mainly produced from the reforming of natural gas, thus giving another reason for investors to focus on this commodity.

On the supply side, the US is expected to ramp up its shale gas production while West African countries are expected to permit new gas projects. Furthermore, top gas exporters such as Qatar, Australia, and Russia are also in the fray to benefit from the growing natural gas demand. The increase in supplies from these natural gas producers is also likely to fuel the large wave of LNG capacity coming online this decade.

Almost a third of the respondents felt that upstream oil would be the most promising segment to look out for in the near future. Soaring fuel demand from Asia is expected to balance the recessionary worries in the West, resulting in promising outlook for crude oil producers as well as refiners. This is likely to attract investment in new greenfield oil projects around the world.

The remaining respondents were split between the two downstream segments of refining and petrochemicals. The demand for petrochemical products, such as ammonia, urea, methanol, polypropylene, polyethylene, and PVC is expected to rise following the pandemic-induced slump. These chemicals are used in the production of basic materials such as fertilisers, plastic, synthetic rubber, detergents, and pipes. The refining segment was also opted as a promising oil and gas segment by about one-seventh of the respondents.

See Also:

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData