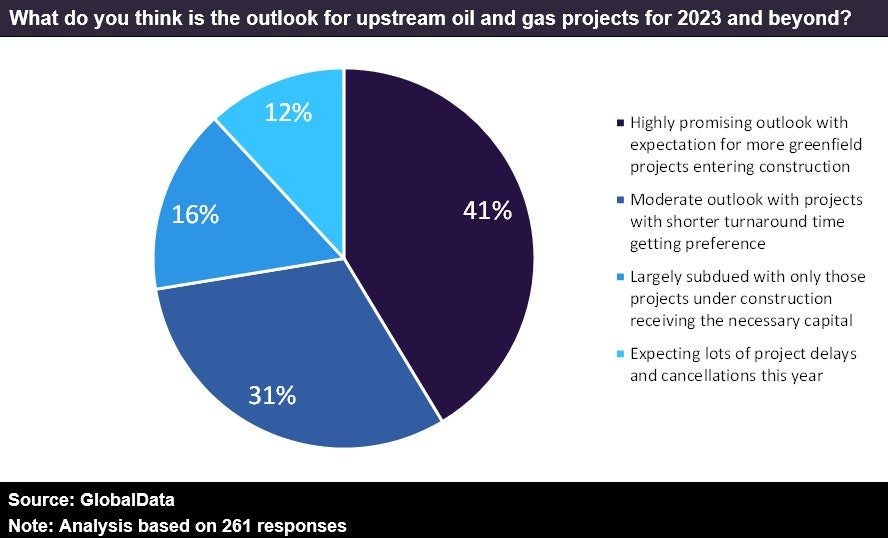

The investment decisions in the oil and gas industry depend on oil prices, which are influenced by global factors, including geopolitical situations, and global economic dynamics. During April-May 2023, GlobalData conducted a poll among industry players to gauge the sentiment on upstream oil and gas projects outlook for 2023 and beyond. This was against the backdrop of the protracted Ukraine conflict and the prevailing high inflation around the world. Amid this scenario, over two-fifths of our respondents were optimistic about upstream project development. They expect companies to announce more greenfield developments despite the impending threat of recession in the West, which could bottle investment streams. The recent news of Germany slipping into a recession has already aggravated global recession fears. On the other hand, crude demand from Asia is anticipated to be strong, while the conflict in Ukraine and the resultant sanctions on Russia continue to weigh on global energy supply. This could provide support to oil prices, thereby enabling industry participants to go ahead with their capital plans in upstream oil and gas. The ongoing strategic production cuts from the OPEC+ group could also prove beneficial in sustaining high oil prices.

Nearly one-third of the respondents said that they expect a moderate outlook for greenfield oil and gas projects in the coming years. The high inflation and stress in the US banking sector, along with probable global recession could weigh down global economic growth and hence, energy demand. In such a scenario, projects with shorter turnaround times could get precedence. Furthermore, some respondents felt that upstream oil and gas project development could witness a more guarded approach in the short to medium term. The group forming about a sixth of the total respondents were of the view that only those projects that have already begun construction, will be able to garner the necessary funds to complete them. This cautious opinion could be due to a gloomy global economic outlook. High consumer inflation in the US and the subsequent interest rate hikes could derail business activity in the world’s largest oil and gas-consuming country. This could have a global domino effect. Also, the growing trend of EVs and the impending shift towards renewable energy sources is expected to hit the oil and gas industry hard in the coming years.