The oil and gas industry has witnessed a shortage of skilled labour in the last few years.

The industry continues to seek a competent workforce to undertake critical tasks that fuel the world economy.

In recent years, there has been a growing shift towards white-collar jobs as compared to blue-collar jobs such as those in oil and gas, which might be one of the factors for this shortfall.

This could be because white-collar jobs offer much safer working environments away from the harsh conditions of an oilfield.

Furthermore, climate change concerns might sway away newer generations such as Gen Z from the emission-intensive oil and gas industry.

See Also:

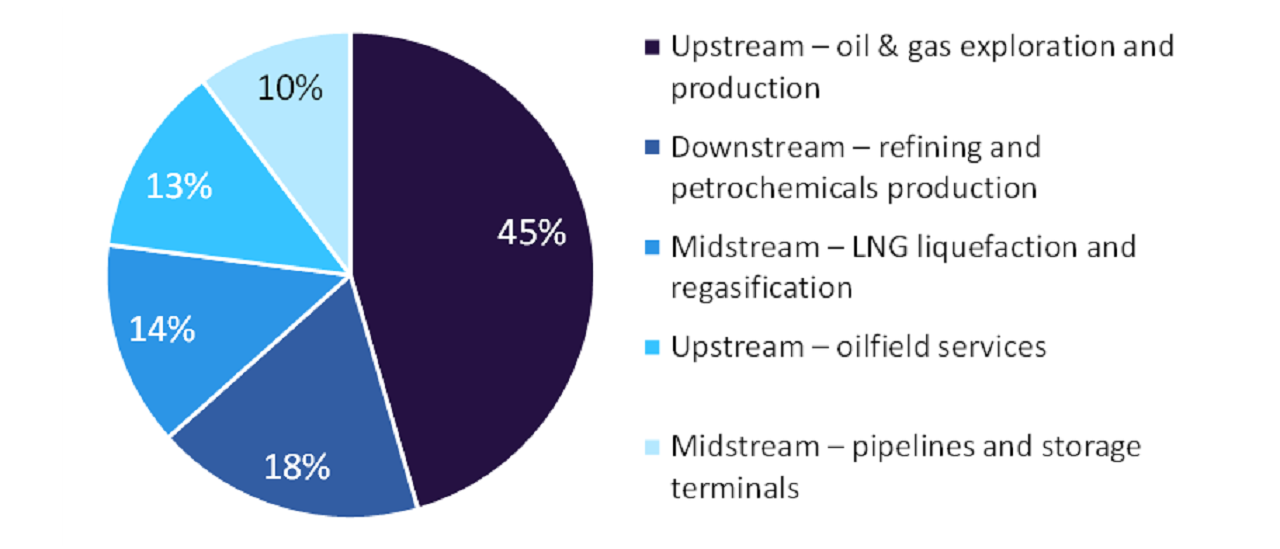

Between November 2023 and January 2024, GlobalData, a leading data and analytics company, conducted a poll to try and gauge what sectors within the oil and gas industry are experiencing the greatest shortage of skilled workers.

Approximately 45% of the respondents said that oil and gas exploration and production activities in the upstream sector are facing the most shortage of skilled workers.

The harsh environments and safety concerns while operating on oil rigs could be preventing younger generations from opting to work in the upstream sector.

This creates a gap in the skilled workforce to manage the operations in critical upstream operations.

Also, the Covid-19 pandemic saw significant layoffs in the oil and gas industry.

These combined incidents may also deter younger people from joining the oil and gas industry.

About 18% of the respondents felt that the refining and petrochemicals segments in the downstream sector are facing the biggest skilled worker shortage.

These sectors require high-level chemical engineers and technicians for their operations.

There are complex technological challenges that come with the trend of establishing integrated refineries, as well as the emergence of low-carbon hydrogen and carbon capture for lowering their emission footprint.

The scarcity of skilled technicians to overcome challenges and carry out these processes could be detrimental to the growth of the refining and petrochemical segments.

Meanwhile, approximately 14% of the respondents believed that the liquefied natural gas (LNG) liquefaction and regasification segments in the midstream sector are predominantly facing a shortage of skilled workforce.

The LNG segment has seen massive growth in the last decade due to the shale boom, and recently due to the sanctioning of Russian gas imports in Europe.

The shortage of a skilled workforce in this segment could impact commodity pricing, as well as new LNG project developments.

Roughly 13% of the respondents felt that the oilfield services in the upstream sector are facing the most shortage of skilled workers.

Oilfield service companies are responsible for feasibility assessments, building, and maintaining upstream infrastructure.

As before, the harsh environments of the upstream operations deter employees from opting for these jobs.

Furthermore, the advent of digital technologies such as AI and the Internet of Things has added a layer of complexity in designing upstream infrastructure.

Also, regulatory mandates for decarbonisation require special expertise from the oilfield services companies.

The lack of a skilled workforce in digital technologies and expertise in environmental, social, and governance compliance could hinder the scaling of the upstream sector to meet the future oil and gas demand.

About 10% of the respondents said that the pipelines and storage terminals in the midstream sector mostly face a lack of skilled workforce.

Midstream operations face challenges such as monitoring a geographically diverse network of assets and the possible threat of leakages from ageing infrastructure.

Lately, pipelines and storage terminals have started employing drone technology to monitor the infrastructure effectively.

The data collected further needs to be analysed to generate actionable insights to improve productivity, as well as security.

There are also threats of cyberattacks such as the ransomware attack on the Colonial Pipeline in the US in May 2021.

The lack of drone pilots, data analysts, and in-house cybersecurity experts could be detrimental to the functioning of pipeline and storage terminals.