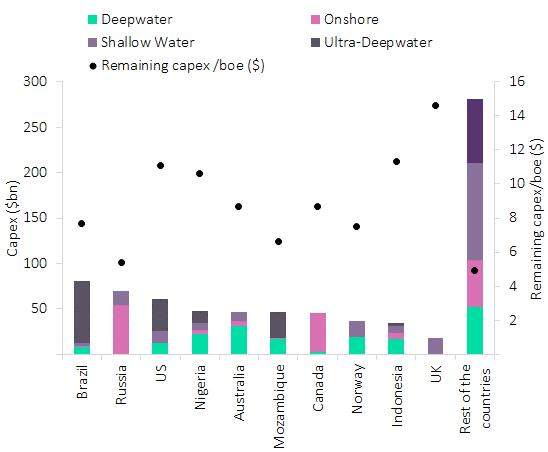

Close to $790bn will be spent between 2018 and 2025 on 615 upcoming oil and gas fields globally, according to a Globaldata analyst. Capital expenditure (capex) into conventional oil, unconventional oil, heavy oil and oil sands projects would form $350bn, $3bn, $40.2bn and $43.4bn of the world’s capital spend respectively over the eight-year period. Conventional gas projects will require $348bn, while the investments into unconventional gas and coal bed methane (CBM) projects would total $5.5bn in upstream capital expenditure by 2025.

Brazil accounts for $80.7bn or over 10.2% of total capex into upcoming projects globally over 2018 to 2025. The country has 48 announced and planned fields. The ultra-deepwater fields Libra Central with $13bn, Carcara with $9bn and Lula Oeste with $6.5bn will require the highest capex over the 8-year period. All three are conventional oil projects.

Russia is expected to contribute about 8.8% to the total capex spending globally between 2018 and 2025. The country has 54 planned and announced fields. Kovyktinskoye, onshore conventional gas field with capex of $9.0bn, Sakhalin 3 (Kirinskoye South (Yuzhno-Kirinskoye)), conventional gas shallow water with a capex of $8.5bn, and Chayandinskoye, conventional gas onshore field with a capex of $5.9bn will have the highest level of capital spending by 2025 among Russia’s upcoming projects

Nigeria, Australia, Mozambique, Canada, Norway, Indonesia, and the UK, together have a capex $277bn, or about 35.9% of the total capex spending on upcoming projects over the next eight years globally.

GlobalData expects that over their lifetime, the 615 upcoming oil and gas projects globally will call for $1,671bn in capex to produce over 86,113 million barrels of crude and 836 trillion cubic feet of gas. Upcoming ultra-deepwater projects will have the highest lifetime capex at $448bn. Deepwater projects will require $307bn over the lifetime, while onshore and shallow water projects carry a total capex of $430bn and $487bn respectively.

Capital expenditure into upcoming projects globally by 2025

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData| Source: Upstream Analytics © GlobalData |