GlobalData’s latest thematic report, Impact of China on Oil & Gas suggests that China’s large domestic demand for oil and gas, and heavy dependency on imports, makes it one of the most lucrative factors when assessing oil and gas industry trends.

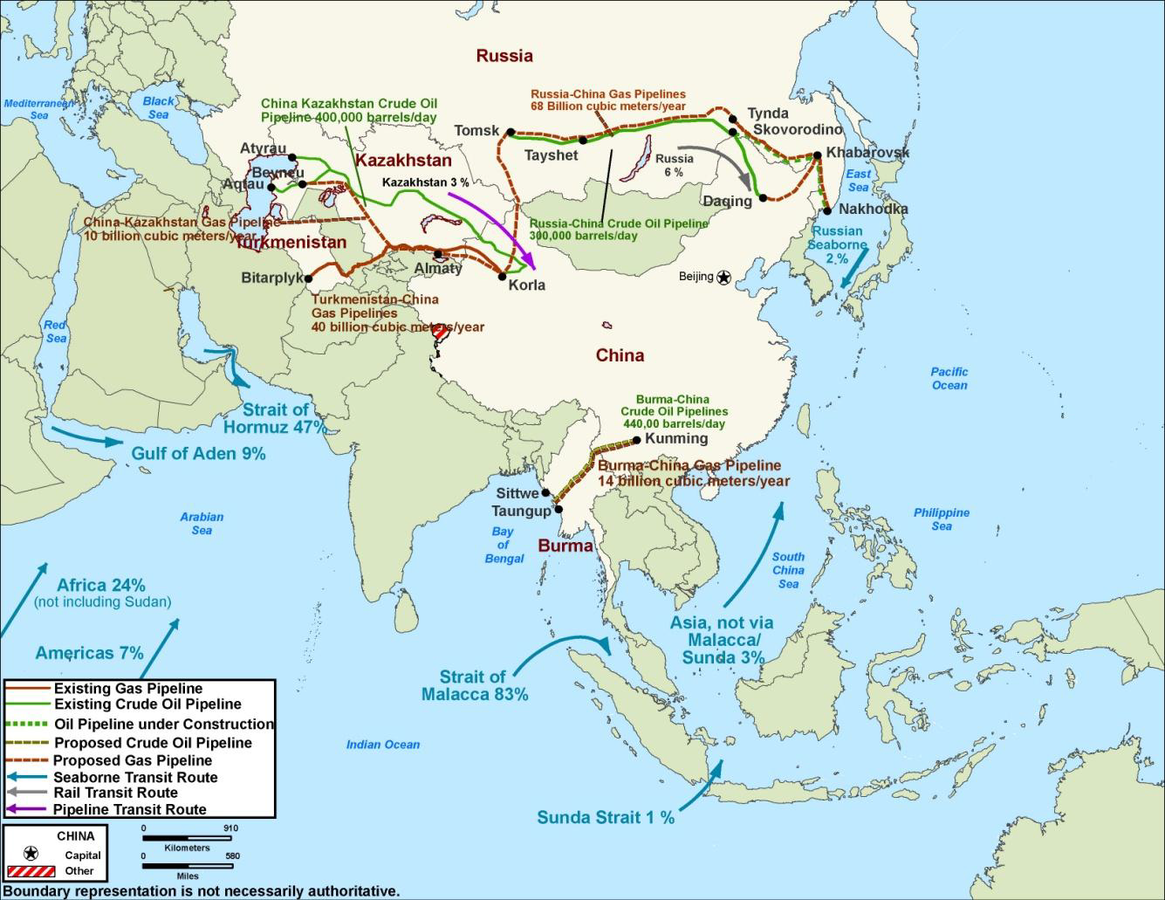

China has started altering its national energy strategy to achieve the dual objective of reducing carbon emissions and ensuring energy sufficiency for domestic consumption. The country, which already exerts a considerable influence on global geopolitics, is attempting to further expand its geopolitical reach to secure oil and gas supply. The Belt and Road Initiative (BRI) introduced by the Chinese government is largely aimed at increasing commodity trade, especially oil and gas, enabling Chinese companies to make strategic investments in oil and gas projects around the world.

Oil and gas industry trends: A focus on China

The sustained growth in consumption of petroleum, natural gas, and petrochemical products in China oil is a major growth driver for oil and gas companies worldwide. Firms can benefit from this opportunity by participating in oil and gas trade with China and through investing in the Chinese oil and gas industry. However, the oil and gas sector in China is largely dominated by the country’s national oil companies (NOCs). The three NOCs – China Petrochemical Corp or Sinopec, China National Petroleum Corp (CNPC), and China National Offshore Oil Corp (CNOOC) – together accounted for around 75% of crude oil production and refinery and petrochemical throughput in China.

GlobalData’s thematic research identifies Sinopec, CNPC, and CNOOC as some of the companies that have strong exposure to China’s oil and gas industry. Shell, Chevron, ConocoPhillips and ExxonMobil are some of the non-Chinese companies that have weak exposure to China.

Chinese oil and gas industry is largely dominated by domestic players

| Source: GlobalData Thematic Research ©GlobalData |

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Related Company Profiles

China National Petroleum Corp

CNOOC Ltd

Chevron Corp

China National Offshore Oil Corp

Shell Co., Ltd.