Egypt hopes to attract new exploration investment to secure long-term gas supplies with its upcoming bid round. The EGAS (Egyptian Natural Gas Holding Company) round, offering 16 blocks in the Mediterranean Sea and the Nile Delta, was opened on May 22 and closes on October 8. It runs alongside a second round organised by the EGPC (Egyptian General Petroleum Corporation) for blocks in the Eastern and Western Deserts, and Gulf of Suez.

With this first offering of Mediterranean blocks since 2015, the government hopes to promote new exploration aimed at securing long term gas supplies to support Egypt’s ambition to be a regional gas hub.

Securing long-term gas supplies through new exploration will be crucial in ensuring domestic supply and allowing Egypt to once again become a significant gas exporter.

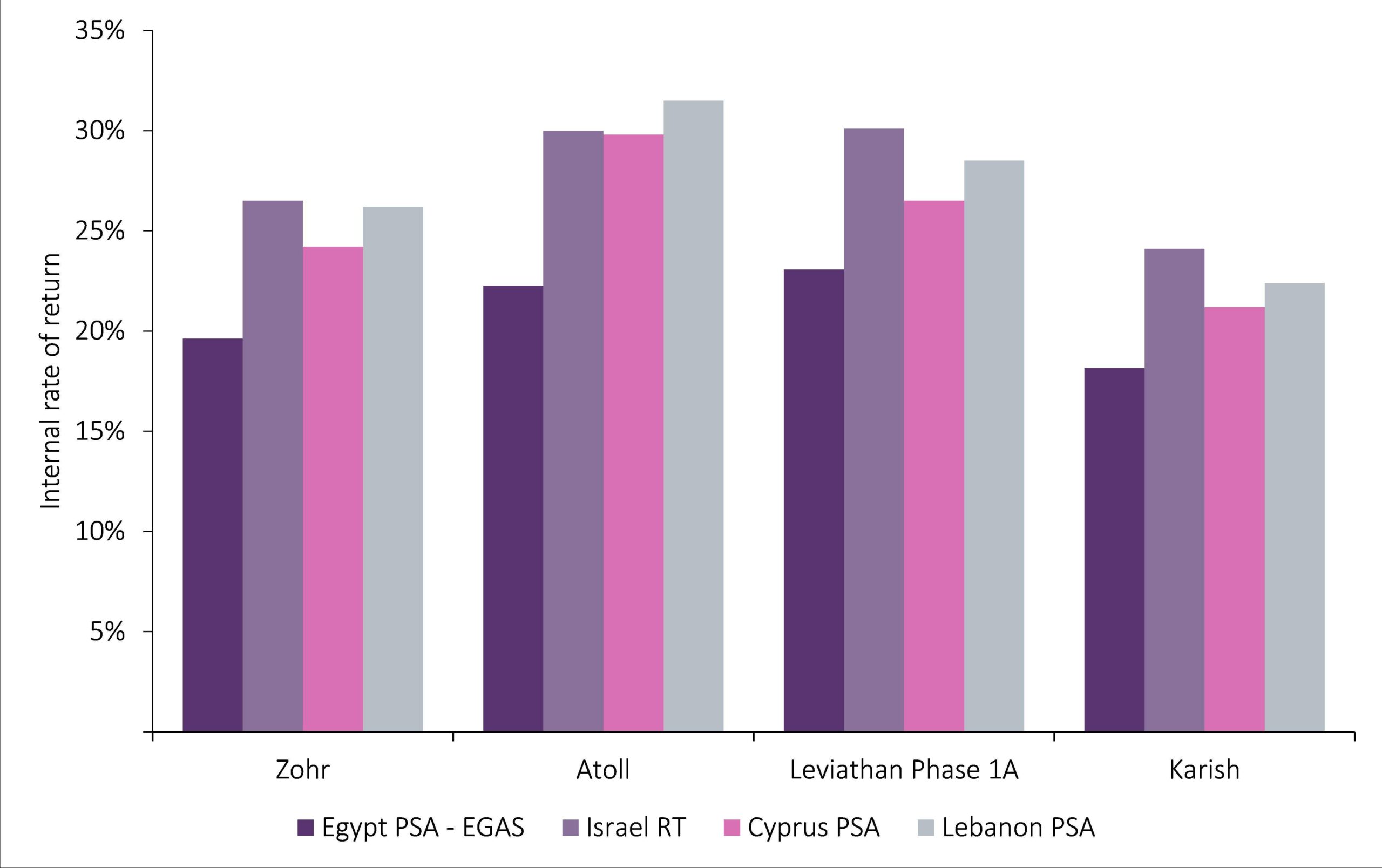

The need for gas supplies in the mid-2020s should also support the commercial attractiveness of the new bid round for E&Ps. Egypt’s fiscal terms are the toughest in the Eastern Mediterranean, a reflection of its status as a more mature oil and gas producer. However, the presence of existing infrastructure and significant local gas demand, combined with the increased gas prices agreed for new supply, have supported significant developments in recent years. These aspects should continue to be of benefit in attracting new exploration, giving explorers some confidence that there will be a ready market for any gas that they discover.

IRR of gas developments under Eastern Mediterranean fiscal regimes

| Source: Upstream Analytics © GlobalData |

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataFor more insight and data, visit the GlobalData Report Store – Offshore Technology is part of GlobalData Plc.