Over $51.5bn in capital expenditure (capex) will be spent over the lifetime of the top ten upcoming oil and gas upstream projects in the US Gulf of Mexico to produce 4.1 billion barrels of oil equivalent, according to GlobalData.

These 10 projects, selected from 28 upcoming projects in the US Gulf of Mexico, will contribute incremental capacity of 598,000 barrels of oil equivalent to global supply by 2025. All the top ten upcoming projects in the Gulf of Mexico basin are conventional oil developments, with four located in deepwater and six located in ultra-deepwater.

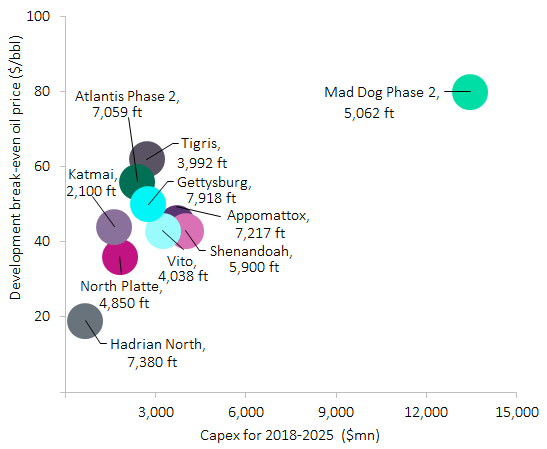

Mad Dog Phase 2 is the largest project, with anticipated peak production at 172,200 barrels of oil equivalent in 2027 at a lifetime capex of $15.8bn. Appomattox is the next-largest project with an anticipated peak production at 106,800 barrels of oil equivalent in 2022 at an estimated lifetime capex of $6.6bn.

Top ten upcoming projects in the US Gulf of Mexico, with respective maximum water depths

Source: GlobalData Upstream Analytics

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataGlobalData reports the average development breakeven oil price for top upcoming ultra-deepwater projects in the US Gulf of Mexico at $48.80 per barrel, while deepwater projects have an average break-even of $46.30 per barrel.

Three of the top ten projects in the US Gulf of Mexico do not meet the return threshold of 10% for internal rate of return, necessitating reductions in capital expenditure, better-than-forecast reserves recoveries, or better price markets. Ultra-deepwater Hadrian North in the US has the highest net present value per barrel of oil equivalent at $5.90.

GlobalData estimates $36.6bn will be spent by 2025 to bring the top ten projects online, while their lifetime capex will exceed $51.5bn. Differentiating for water depth, GlobalData expects full-cycle capital expenditure per barrel of oil equivalent to average at $11.10 for deepwater and $12 for ultra-deepwater.