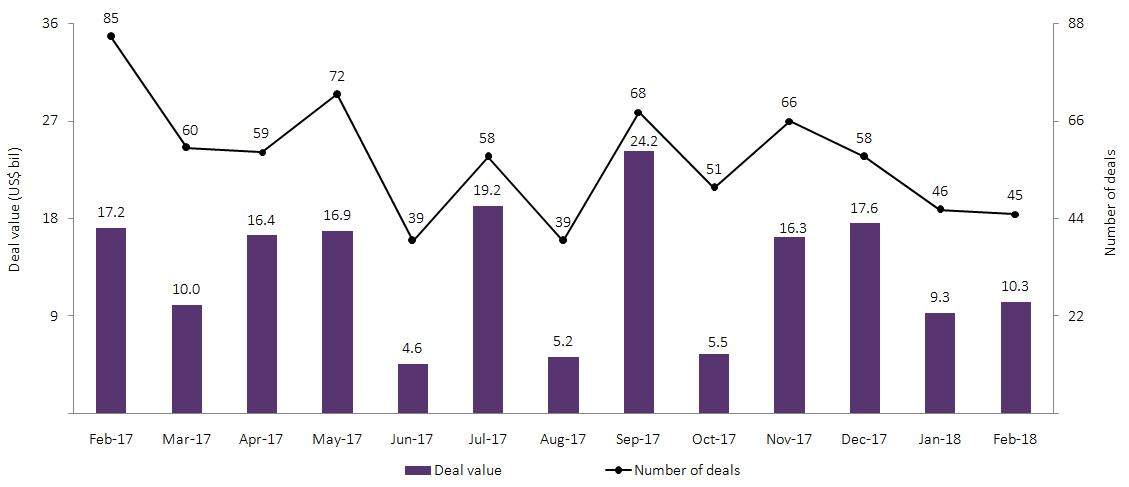

GlobalData’s latest report, ‘Monthly Upstream Capital Raising Review – February 2018, shows that global raising activity in the upstream sector totalled $10.3bn in February 2018. This was an increase of 11% from the $9.3bn in capital raising deals announced in the previous month. On the volume front, the number of capital deals decreased marginally from 46 in January 2018 to 45 in February 2018.

A year-on-year comparison shows a decline of 40% in deal value in February 2018, when compared to February 2017’s value of $17.2bn. The month recorded 12 capital raising deals with values greater than $100m, together accounting for $9.9bn.

Capital raising, through debt offerings, witnessed an increase of 12% in deal value, recording $6.7bn in February 2018, compared with $6bn in January 2018. Capital raising, through equity offerings, registered a substantial increase of 110% increase in deal value, with $2.3bn in February 2018, compared with $1.1bn in January 2018. Further, three private equity/venture capital deals, with a combined value of $1.3bn, were recorded in February 2018.

Petroleos Mexicanos’ pricing of the public offering of notes, for gross proceeds of $4bn. The notes are priced at 100% of the principal amount. The company intends to use the proceeds from the offering to purchase notes validly tendered and accepted for purchase in the tender offers, to finance its investment program, and for working capital purposes.

Upstream Capital Raising Deal Value and Count, February 2018

Source: Oil & Gas Deals Analytics © GlobalData

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

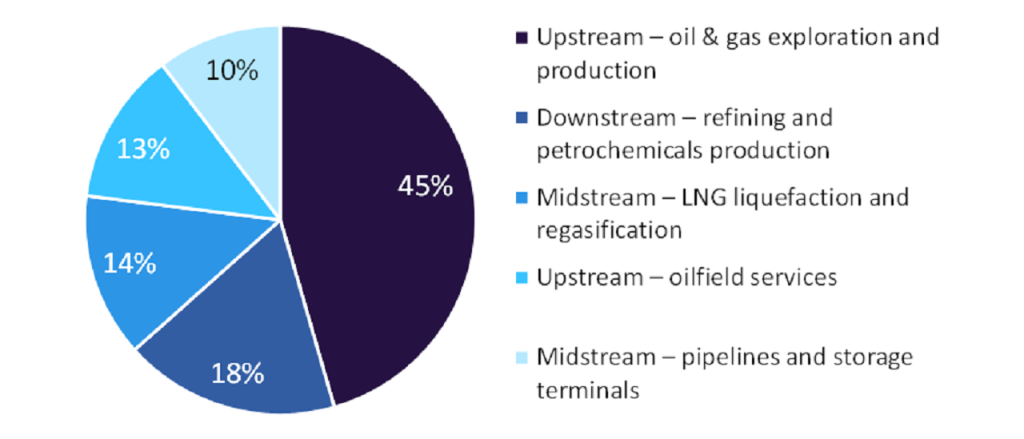

By GlobalDataRegionally, Americas led the global capital raising market in terms of volume and deal value, with 22 deals worth a combined value of $7bn, in February 2018. The Europe Middle East and Africa (EMEA) registered 10 deals, of a combined value of $866.4m; while Asia-Pacific recorded 13 capital raising deals, with a combined value of $2.4bn in February 2018.

Related Company Profiles

Americas

EMEA S.r.o.

UOP Asia Pacific Pte Ltd