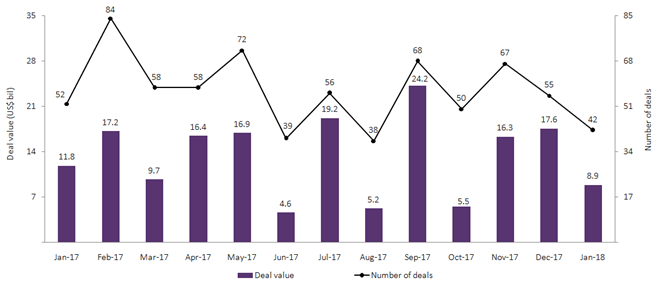

GlobalData’s latest report, ‘Monthly Upstream Capital Raising Review – January 2018’, shows that global raising activity in the upstream sector totalled $8.9bn in January 2018.

This was a decrease of 49% from the $17.6bn in capital raising deals announced in the previous month. On the volume front, the number of capital deals decreased by 24% from 55 in December 2017 to 42 in January 2018.

A year-on-year comparison shows a decline of 25% in deal value in January 2018, when compared to January 2017’s value of $11.8bn. The month recorded 15 capital raising deals with values greater than $100m, together accounting for $8.5bn.

Capital raising through debt offerings witnessed a substantial decrease in deal value, recording $5.5bn in January 2018, compared with $14.5bn in December 2017. Capital raising through equity offerings registered a 21% increase in deal value, with $1.1m in January 2018, compared with $868.1m in December 2017. Seven private equity/venture capital deals, with a combined value of $2.3bn, were recorded in January 2018.

Upstream capital raising deal value and count, January 2018

Source: GlobalData Oil & Gas Deals Analytics

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataPetroleo Brasileiro’s public offering of 5.75% senior unsecured notes, due February 1, 2029, for gross proceeds of $2bn, was one of the top deals registered in January 2018. The notes were priced at 98.4% of the principal amount to yield 5.95% at maturity. Interest on the notes will be payable semi-annually on February 1 and August 1 of each year, beginning on August 1, 2018.

The company intends to use the proceeds from the offering to fund the redemption of its existing 3% global notes due January 2019, 7.875% global notes due March 2019, and 3.25% global notes due April 2019; to repay other existing debt; and for general corporate purposes.

Regionally, the Americas led the global capital raising market in terms of volume and deal value, with 28 deals worth a combined value of $7.1bn in January 2018. Europe, the Middle East and Africa (EMEA) registered eight deals representing a combined value of $1.1bn; while Asia-Pacific recorded six capital raising deals with a combined value of $704.1m in January 2018.

Related Company Profiles

Petroleo Brasileiro SA

UOP Asia Pacific Pte Ltd