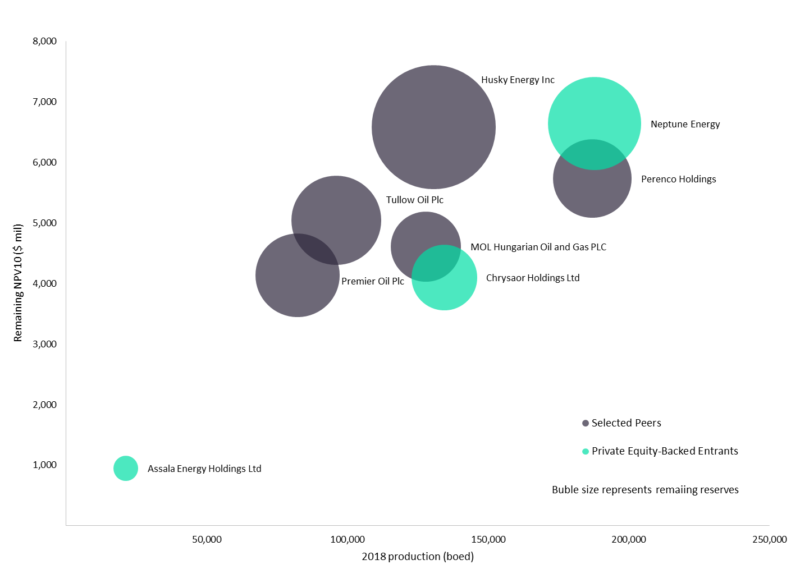

The completion of Neptune Energy’s acquisition of Engie E&P International follows a trend of private equity-backed companies purchasing legacy E&P assets, but this transaction, which all but removes Engie from the upstream sector, is on a much larger scale. Neptune Energy’s portfolio is larger than those of major independents such as Tullow Oil and Premier Oil, and of a similar scale to that of Perenco.

In addition to scale, the company has an international scope: while European assets make up 80% of the reserves base, major gas projects in Algeria and Indonesia represent 37% of the portfolio’s value. The portfolio is heavily gas-weighted, with gas and natural gas liquids constituting 78% of total reserves.

As the company looks to grow, it will soon benefit from the addition of production from the Touat gas field in Algeria, set to come on stream this year. Aside from potential further acquisitions and exploration opportunities, discovered resources in the portfolio such as Cara and Tornerose in Norway and the stalled Bonaparte LNG project in Australia, may also provide Neptune with ready-made growth options to act on in the short-to-medium term.

Scale of Neptune Energy vs other private equity entrants and selected peers

Source: GlobalData Upstream Analytics & Economics

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Related Company Profiles

Engie SA

Tullow Oil Plc

Harbour Energy PLC

Neptune Energy