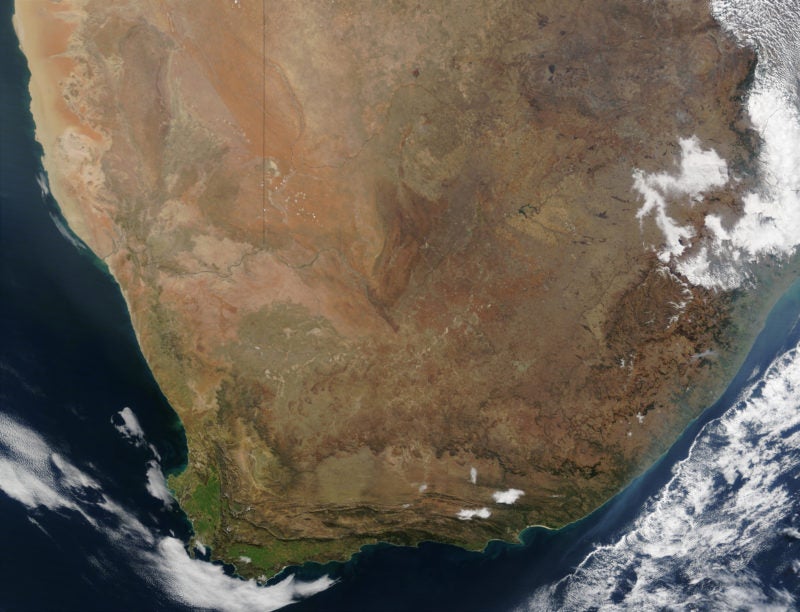

Attractive fiscal terms in Namibia and South Africa make for impressive potential rewards, balancing the offshore exploration risk. Recently, majors have acquired significant acreage in the two countries for offshore drilling in southern Africa, positioning themselves to build on any potential future successes.

There have been relatively few discoveries on both sides of the southern South Atlantic margin. Both countries license acreage under royalty and tax regimes, with low royalty rates capped at 5% on gross production.

In Namibia, the regime includes a tiered additional profits tax (APT) that applies a 25% tax on post-tax profits when the investor’s internal rate of return (IRR) is greater than 15%. A further two biddable APT rates are levied if a project’s IRR exceeds 20% and 25%, respectively.

In South Africa, investors are granted a 100% uplift on exploration expenditure that leads to successful developments, and a 50% uplift on all other capital expenditure.These progressive elements suit the high risk and cost nature of the area, limiting the fiscal burden on projects’ rates of return.

The assessment suggests that the Namibia and South Africa regimes promise higher rates of return for investors than those of many other countries along the southern South Atlantic coastline.

Figure: Internal rate of return of Sea Lion Phase 1 development under South Atlantic margin regimes

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData*Oil Price $65. Source: Upstream Analytics &Economics, GlobalData Oil and Gas. © GlobalData

Large E&P companies are anticipating the results of these wells having recently acquired significant acreage holdings in both countries, and will be looking to build on any potential future successes. Between 2017 and 2018, seven major entry deals were announced or have been completed.

The lack of offshore exploration success and consequently higher exploration risk means that in order to attract investment, the countries need to offer attractive fiscal terms. These terms allow higher potential rewards from any discoveries that may result from the upcoming drilling campaigns in the under-explored region. Offshore drilling in southern Africa is set to become a high-profile exploration area in the short-to-medium term and any successful results may have wider repercussions along the Argentinian conjugate margin, which launched its first offshore licensing round in November 2018.