The introduction of the gross split production-sharing contract (PSC) in late 2016 was intended to stimulate investment in upstream oil and gas in Indonesia by streamlining the regulation of the sector. So far, the only major commitments under the new contract have been from Pertamina.

The gross split PSC removes the cost recovery element, with all production directly split between the government and the participants. By the end of 2018, nine mature licenses will be under the gross split PSC, with Pertamina appointed as the sole participant subject to back-in rights from the local governments.

The adjustments made in September 2017, improving the available variable factors, significantly increases returns for Pertamina, mitigating the downside risk resulting from the removal of cost recovery.

With the license expiry for the largest oil producing block in Indonesia, Rokan, coming up in 2021, the Indonesian Ministry of Energy and Mineral Resources (ESDM) announced at the end of July that Pertamina will replace Chevron as sole participant in the license. Chevron’s proposal for a renewal of the previous cost recovery PSC was rejected and ESDM favored Pertamina’s bid under the improved gross split PSC, awarding it a 20-year contract, until 2041. Taking on Rokan fits with Pertamina’s mandate to increase its role as an upstream operator domestically.

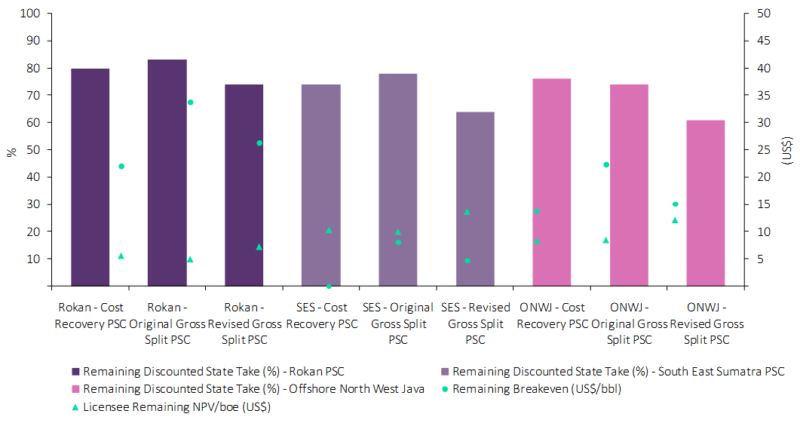

Figure 1: comparison of Rokan, South East Sumatra (SES) and Offshore North West Java (ONWJ) under Cost Recovery PSC, Original Gross Split PSC and Revised Gross Split PSC

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataA key factor in the winning bid was Pertamina giving a signature bonus of $784m to the government. Legislation passed in May 2018 removed the upper limit of $250m on the signature bonus. Pertamina previously paid $79.5m in signature bonuses for nine licenses renewed under gross split, with the highest at $41m for Mahakam.

The improved terms are also set to benefit Pertamina, as investors relinquished licenses without much competition given the outlook under the original gross split PSC. Pertamina’s focus has been on acquiring mature expiring licenses with highly competitive offerings to the government, while international companies have had more success winning new licenses in the bid rounds.

The current gross split incentivises the participants to optimise investments, but they would also be taking on more risk under the gross split PSC. In addition, the lack of recent exploration success and competiveness of fiscal terms in neighbouring countries has limited the impact of the gross split PSC so far.

Related Company Profiles

PSC, LLC

Chevron Corp

Pertamina