Perupetro on behalf of the Peruvian government is making significant efforts to improve the upstream sector through new licensing mechanisms paired with a revision of hydrocarbon regulations, and complemented by joining the Extractive Industry Transparency Initiative (EITI).

These measures have already resulted in an increasing interest in Peru, particularly in its offshore frontiers. Moreover, a centralisation of tasks within Perupetro through a reform of the hydrocarbon law could ease the bureaucracy burden for E&P companies.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

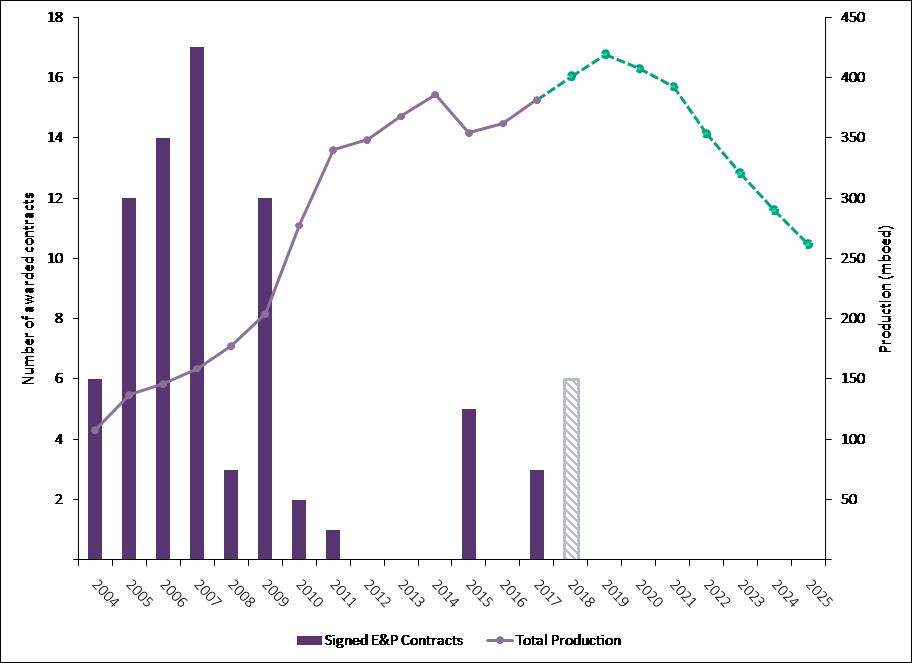

By GlobalDataHowever, the reform of the hydrocarbons law and royalty regime are not yet finalised and could be delayed, having originally been expected for 2017. Last but not least, the on-going changes are not expected to reverse the production decline from 2020 onward in the short-to mid-term.

Although Peru shares the prolific Andean forelands basins ranging from Argentina to Colombia and holds significant hydrocarbon reserves, the country is less recognised as a major hydrocarbon producer compared to its South American neighbours.

Despite favourable fiscal terms, a lack of licensing rounds coupled with the recent downturn resulted in a lack of investments in the exploration and production sector. One of the perceived challenges to do business in Peru is the high regulatory burden, decelerating and impeding an otherwise more flourishing hydrocarbon sector.

Production and Awarded Licenses, 2000 onwards |

| Source: Upstream Analytics © GlobalData |

However, conditions for licensing are improving by introducing direct negotiations and technical evaluation agreements. Under this regime, three offshore blocks have been awarded to Anadarko in the past year followed by awarding six offshore licenses to Tullow Oil in 2018, pending on governmental approval.

Complementary to the direct negotiations, companies are allowed to redefine block areas in line with their geological understanding of the area. Perupetro has also introduced technical evaluation agreements (TEA), which allow E&P players to license frontier blocks for two years, getting access to Perupetro’s database and in return requiring a light work program, with the aim to encourage exploration and sign future exploration and exploitation contracts.

Perupetro has stated that the current royalty regime scheme is not adequate to reflect abrupt changes in petroleum prices resulting in lower stake takes. To address this issue, Perupetro is proposing to reform the royalty system including factors based on production, oil prices and profitability. Alternatively, a function based on area, well productivity, production and hydrocarbon price could be introduced.

While current production would not be affected by a new royalty due to the fiscal stabilisation act, it would rather impact new exploration contracts providing production growth for the mid to long-term.

Related Company Profiles

E~iti Ltd.

Tullow Oil Plc

PeruPetro SA

TEA S.p.A.