The upstream sector accounted for a reported 60% of the total awarded contracts, with 528 contracts in Q2 2018. The midstream sector recorded 173 contracts, representing 20% of the total awarded contracts, followed by 145 contracts in the downstream sector, representing 16% of the contracts during the quarter.

The notable contracts during the quarter, included Samkang S&C’s $1.9bn contract for the construction of four Very Large Crude Carriers (VLCCs); Renaissance Heavy Industries’ $1.52bn subcontract from Tecnimont Russia to provide construction and installation works for Gazprom’s Amur Gas Processing project with design capacity of 42 billion cubic meters per year in Russia; StroyTransNefteGaz’s $1.18bn contract from Gazprom for the construction of two sections (319km and 219km), as part of onshore section of the Nord Stream 2 twin 1,200km gas pipelines; Aibel’s $1.02bn EPC contract for the 23,000tons deck of the process platform (P2) associated with Johan Sverdrup Phase II development project in the Norwegian North Sea.

Operations and maintenance (O&M) represented 47% of the awarded contracts in Q2 2018, followed by contracts with multiple scopes, such as construction, design and engineering, installation, O&M, and procurement, which accounted for 18%.

Saipem was the top contractor in the upstream sector, with $1.3bn in contracts during Q2 2018, while Equinor was the top issuer, with $7.84bn in awarded contracts. In midstream, Samkang S&C was the top contractor, with $1.9bn and Maire Tecnimont was the top issuer, with $1.52bn. The downstream sector has witnessed TechnipFMC as the top contractor, with $2.26bn, and Middle East Oil Refinery as the top issuer, with $1.7bn in awarded contracts.

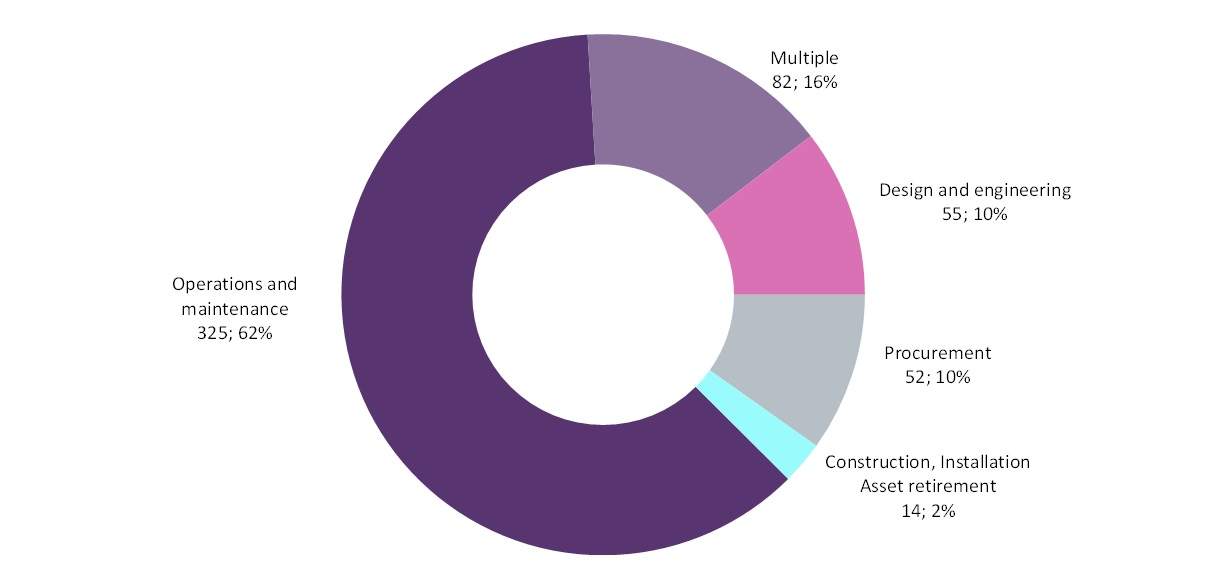

Upstream contracts by scope and count, Q2 2018

Source: Equipment and Services Analytics © GlobalData

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataWithin the largest sector by awarded contracts, the upstream sector, O&M accounted for around 62% of contracts. There were contracts for charter of Anchor Handling Tug Supply (AHTS) vessels, Platform Supply Vessels (PSV), Multi-Purpose Vessel (MPV), Construction Support Vessel (CSV), flexible lay and construction vessel; accommodation barge, semi-submersible drilling rig, workover rig, and jack-up rigs; provision of Floating Production, Storage, and Offloading (FPSO) vessel; provision for vertical and directional drilling and well completion services; inspection and mobilisation of casing and tubing for wells; provision of coatings for platforms; provision of maintenance and services for fire and safety equipment at field; provision of Oil Country Tubular Goods (OCTG) services; provision of subsea tie-in services for development wells; and provision of diving and Remotely Operated Underwater Vehicle (ROV) services.

Contracts with multiple scopes accounted for 16% of the contracts awarded in the upstream sector in Q2 2018. There were contracts for the provision to design and fabrication of extension spools for field development project; engineering, fabrication, installation, and pre-commissioning of subsea infield flowlines, production umbilicals, and related subsea equipment for field development project; EPC of the process platform, comprehensive offloading system, utility module; EPC of Wellhead Platform (WHP) and Brownfield Integrated Module (BIM); EPC of subsea equipment, including Enhanced Horizontal Christmas Trees (EHXT) as well as wellheads, subsea control systems, manifolds, tie-in systems and Intervention Work Over Control Systems (IWOCS); Engineering, Procurement, Construction, and Installation (EPCI) as well as loading, mooring, and transport of drilling platforms; Engineering, Procurement, Construction, Installation, and Commissioning (EPCIC) of Subsea Umbilicals, Risers, and Flowlines (SURF) and Subsea Production Systems (SPS); procurement and construction of wellhead deck, piles and conductors for the field development project; provision for full technical services including subsurface, drilling and production engineering; provision of full-scale mooring and anchoring services; Engineering, Procurement, and Construction Management (EPCM) services including brownfield modifications, platform integrity and equipment upgrades, pre-decommissioning and decommissioning services; provision of project management, design, procurement, assembly, and testing of fire and safety equipment at field; provision of Perforate, Wash, and Cement (PWC) jetting system; transportation and installation of central processing platform jacket, topside float-over, wellhead platform, flexible pipelines, subsea power cables and auxiliary services; and supply, installation, integration with Distributed Control System (DCS).

Related Company Profiles

Maire Tecnimont SpA

Construction Management

MT Russia LLC

StroyTransNefteGaz

Gazprom