GlobalData’s latest report, Quarterly Upstream M&A and Capital Raising Deals Review – Q2 2018, shows that global M&A and raising activity in the upstream sector totalled $51.8bn in Q2 2018. This was a decrease of 16% from the $61.8bn in M&A and capital raising deals announced in Q1 2018. On the volume front, the number of deals decreased by 4% from 410 in Q1 2018 to 394 in Q2 2018.

A total of 142 M&A deals, with a combined value of $8.1bn, were recorded in the conventional segment, and 92 deals, with a combined value of $14bn, were recorded in the unconventional segment.

Capital raising, through debt offerings, witnessed a significant increase of 46% in deal value, recording $26.2bn in Q2 2018, compared with $17.8bn in Q1 2018. The number of debt offering deals also increased by 49% from 39 in Q1 2018 to 58 deals in Q2 2018. Capital raising, through equity offerings, registered a decrease of 22% in the number of deals and 55% in deal value with 91 deals, with a combined value of $2.5bn in Q2 2018, compared with 116 deals, of a combined value of $5.6bn, in the previous quarter. There were 11 private equity/venture capital deals, with a combined value of $950.3m recorded in the upstream industry in Q2 2018, compared to 16 deals, with a combined value of $3.6bn in Q1 2018.

One of the top M&A deals of Q2 2018 was Baytex Energy’s agreement to acquire Raging River Exploration for a purchase consideration of $2.1bn. Raging River holds a 100% working interest in approximately 260,000 net acres of lands in the East Duvernay shale oil play in central Alberta. The company also owns approximately 460 net sections (294,400 acres) of land in the Viking area. As of December 31, 2017, Raging River had proven (1P) reserves of approximately 72.7 million barrels (mmbbl) of oil, 25.148 billion cubic feet (bcf) of natural gas, and 245.4 thousand barrels (mbbl) of natural gas liquids (NGLs); and proven and probable (2P) reserves of approximately 94.33mmbbl of oil, 32.213bcf of natural gas, and 316.2mbbl of NGLs. Raging River had production of approximately 24,118 barrels of oil equivalent per day (boed) during the first quarter of 2018. The transaction implies values of $88,315.78 per boe of daily production, $27.62 per boe of 1P reserves, and $21.3 per boe of 2P reserves.

One of the top capital raising deals of Q2 2018 was Petroleos Mexicanos’ private placement of bonds for gross proceeds of around $3.7bn. Deutsche Bank AG, Societe Generale SA, BBVA Bancomer SA, and Santander Investment SA acted as placement agents to the company for the offering. The company intends to use the proceeds from the placement to repurchase a billion euro-bond which is going to mature in 2019, and for investment project.

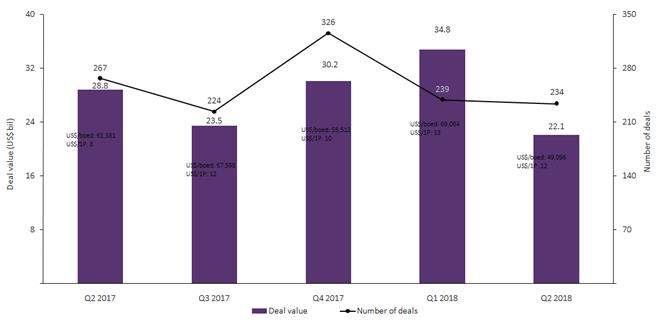

Upstream M&A Deal value and count, Q2 2018

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataSource: Deals Analytics, GlobalData Oil and Gas © GlobalData

Upstream capital raising deal value and count, Q2 2018

Source: Deals Analytics, GlobalData Oil and Gas © GlobalData

Related Company Profiles

BBVA Mexico SA

Santander Investment S.A.

Societe Generale SA

Petroleos Mexicanos

Deutsche Bank AG