Sub-Saharan Africa’s gas production will grow by 18% by 2021 to 9.1 billion cubic feet per day (bcfd), according to GlobalData’s latest analysis of the region. Over 6.4 bcfd of natural gas in 2021 will be produced by conventional gas projects, while coal bed methane (cbm) projects will contribute 8.5 million cubic feet per day (mmcfd) to Sub-Saharan Africa production in 2021. Conventional, unconventional, and heavy oil projects together will contribute about 2.6 bcfd of associated gas by 2021.

Nigerian National Petroleum Corporation will drive Sub-Saharan Africa’s gas production with a 34.2% share of all production in 2021. Royal Dutch Shell Plc and Eni SpA follow with 10.4% and 7.8% respectively. Sub-Saharan Africa has 28 key upcoming gas projects, of which, 16 will be producing by 2021. Empresa Nacional de Hidrocarbonetos EP and Eni SpA will lead in greenfield gas projects, with six projects each, followed by Exxon Mobil Corp with five projects in the near future.

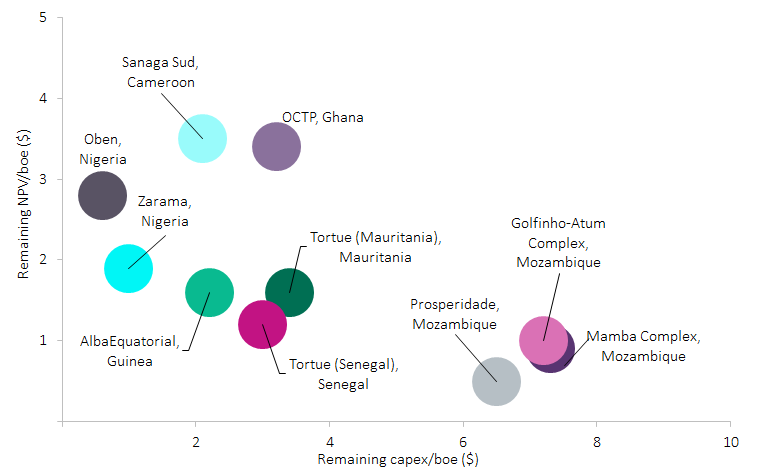

Top ten gas projects in Sub-Saharan Africa in terms of remaining NPV (US$ mil)

Source: GlobalData Upstream Analytics. © GlobalData

Sub-Saharan Africa is expected to spend $33bn as capex on conventional gas and CBM projects during 2018 to 2021, with spending topping in 2021 at $11.8bn. Average full cycle capex per barrel of oil equivalent (boe) for Sub-Saharan Africa gas projects is $4.50. CBM projects have full-cycle capex of $5.30 per boe, while conventional gas projects need $4.50 per boe in full cycle capex. Deepwater projects have the highest average full cycle capex of $7 per boe, followed by shallow-water, ultra-deepwater and onshore projects with an average full cycle capex per boe of $5.40, $5 and $2.70 respectively.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataNew gas projects average $5.10 per boe in capex and need a gas price of $6 per mcf to break even over the development timeline. Average development break-even price for planned and announced ultra-deepwater projects in Sub-Saharan Africa is $6.40 per mcf, while the shallow water and deepwater projects have a development break-even price of $6.90 and $5 per mcf respectively. Onshore projects require a gas price of $3.90 per mcf to break even.

For more insight and data, visit the GlobalData Report Store – Offshore Technology is part of GlobalData Plc.

Related Company Profiles

Empresa Nacional de Hidrocarbonetos EP

Eni SpA

Shell plc

Offshore Technology Corp

Exxon Mobil Corp