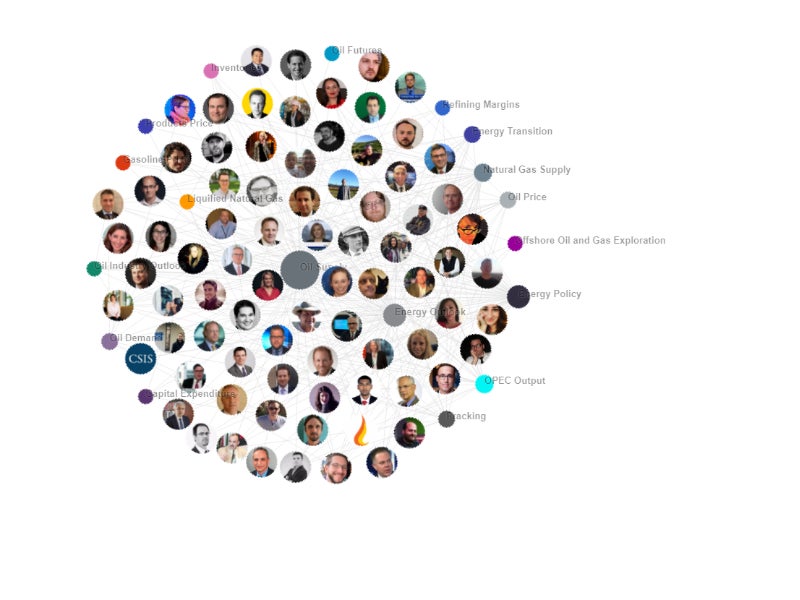

Leading Influencers in the Oil and Gas Industry

Offshore Technology takes a look at the top influencers in oil and gas supply, with help from the GlobalData influencer platform.

Top ten influencers in oil and gas supply

1) Giovanni Staunovo

CHART: Saudi crude exports in mbpd (Source: JODI), November and December data based on comments of energy minister al-Falih #OOTT pic.twitter.com/0HgNlrlyzh

— Giovanni Staunovo🛢 (@staunovo) December 18, 2018

Job title: Commodity Analyst, UBS Wealth Management

Bio: Giovanni is a commodity analyst at UBS Wealth Management. He has previously worked as a G10 FX strategist at UBS and, prior to that, spent two years working as a research assistant at the Swiss National Bank, within the money market and foreign exchange department.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData- Twitter followers: 10,517

- GlobalData influencer score: 100

2) Anas Alhajji

Green shoots?

A freeze kills green shoots and ruins the whole season! Be carful of the freeze! #Oil pic.twitter.com/kn1U2lWByq

— Anas Alhajji (@anasalhajji) December 19, 2018

Job title: Oil and Gas Consultant

Bio: Anas is a respected energy economist, research, writer and speaker, who focuses topics such as the oil and gas market outlook, energy geopolitics and security, and digital disruption in the supply and demand of energy. He has held positions such as Managing Partner at Energy Outlook Advisors LLC, and Chief Economist at NGP Energy Capital Management.

- Twitter followers: 27,500

- GlobalData influencer score: 83

3) Samir Madani

With oil crashing 40% in less than a quarter, it is once again abundantly clear that following narratives such as $100 can end up badly. Unless your paycheck comes from the oilfield, you have no real reason to trade with bias. Go long, go short, but just don’t put a ring on it. pic.twitter.com/Pi05CI07LH

— Sam (@Samir_Madani) December 18, 2018

Job title: Oil and Gas Consultant

Bio: Samir is an entrepreneur that worked in the technology industry for 20 years before leaving to monitor the oil and gas supply. In 2016, he co-founded daily oil volume and price tracker website Tanker Trackers and the Organization of Oil-Trading Tweeters, which provides the industry real-time news and statistics on global oil markets.

- Twitter followers: 24,923

- GlobalData influencer score: 76

4) Ed Crooks

The oil market in the aftermath of decisive action by the OPEC+ group on Friday pic.twitter.com/ezRd3ldHSL

— Ed Crooks (@Ed_Crooks) December 10, 2018

Job title: US industry and Energy Editor, Financial Times

Bio: Ed has been with the Financial Times since 1999, serving as energy editor, UK news editor and economics editor in London, UK, before becoming US industry and energy editor in New York. Prior to that, Ed worked as an economics correspondent for the BBC, reporter and editor for Investors Chronicle and also an economic analyst at the Institute for Fiscal Studies.

- Twitter followers: 35,888

- GlobalData influencer score: 70

5) Lisa Ward

U.S. #Oil Rigs Rise as Canadian Rigs Fall With Record Production #OOTT #natgas $USO https://t.co/1Mfas1zF9X pic.twitter.com/P2GoKCPVgh

— Traders Community (@TradersCom) November 30, 2018

Job title: Energy Consultant

Bio: Lisa is a co-founder of Tanker Trackers and the Organization of Oil-trading Tweeters. She has more than six years’ experience in the field of finance and banking, holding roles in operations, customer relations, project management, accounts and treasuries, among a range of other job functions.

- Twitter followers: 10,766

- GlobalData influencer score: 64

6) Herman Wang

#OPEC enters a pivotal third year of production cuts in a volatile oil market with its least experienced minister as its president: #Venezuela's Manuel Quevedo #OOTT #PDVSA #Maduro @CroftHelimahttps://t.co/jkbA0x9ckC pic.twitter.com/GqX4h9Me8T

— Herman Wang (@HermsTheWord) December 19, 2018

Job title: Senior Writer, S&P Global Platts

Bio: Herman is London-based senior writer covering OPEC developments for energy markets and industry news service Platts. Before this, Herman worked in Washington, DC, covering Congress and federal politics for newspapers and financial media.

- Twitter followers: 9,369

- GlobalData influencer score: 63

7) Jennifer A Dlouhy

Three companies bid a record-shattering $405.1 million to nab U.S. rights to build offshore wind farms near Massachusetts on Friday, a testament to the surging appeal of renewable power and investors’ growing confidence in demand for it.

— Jennifer A. Dlouhy (@jendlouhyhc) December 14, 2018

Job title: Energy and Environmental Policy Reporter, Bloomberg

Bio: Since 2015, Jennifer has worked at Bloomberg as an energy and environmental policy reporter, writing about environmental regulations and energy policy in Washington, DC. Prior to that, Jennifer spent 10 years as a Washington, DC correspondent for the Houston Chronicle, covering energy with a special focus on oil and gas.

- Twitter followers: 23,787

- GlobalData influencer score: 63

8) Ernest Scheyder

Five oil majors face 2019 climate target pressure by investors https://t.co/F0hISK5O7O pic.twitter.com/5ERgC9H0j1

— Reuters (@Reuters) December 19, 2018

Job title: National Energy Correspondent, Reuters

Bio: Ernest is a national energy correspondent for the North American energy industry at Reuters. He covers technological, political and regulatory developments affecting the oil and natural gas industry. He spent almost two years at the Bakken shale oil patch in North Dakota, where he wrote about the fracking boom and bust.

- Twitter followers: 7,409

- GlobalData influencer score: 63

9) Lee Saks

al-Falih comments from earlier today:

*SAUDI ARABIA TO CUT 400K B/D IN JAN.

*OPEC COUNTRIES SAID THEIR OUTPUT WILL DROP BY 3% IN JAN.

*I AM SURE WE WILL EXTEND CUTS DEAL IN APRIL

*WE WILL ACHIEVE OIL MKT BALANCE IN '19

*OIL DROP DUE TO POLITICS IRAN SANCTIONS TRADE ISSUES#OOTT— Lee Saks (@Lee_Saks) December 19, 2018

Job title: Futures/FX trader

Bio: Lee is a Futures/FX trader in New York City, US.

- Twitter followers: 20,147

- GlobalData influencer score: 63

10) Jesse Jenkins

The District of Columbia passed an omnibus Clean Energy Act yesterday which will (among other things) require the electricity utilities serving DC to procure 100% of their electricity from renewable sources by 2032 (of which 5% must be from solar) https://t.co/BETbCmkAin

— JesseJenkins (@JesseJenkins) December 19, 2018

Job title: Independent Energy Consultant

Bio: Jesse is an independent consultant and researcher with more than 10 years’ experience in the energy sector. His areas of expertise include electric power systems, electricity regulation and markets, energy economics, climate change policy and innovation. In September 2018, Jesse began a post-doctoral environmental fellowship at Harvard Kennedy School.

- Twitter followers: 19,473

- GlobalData influencer score: 61

Methodology

The analysis provided by GlobalData is based on relevance, the number of followers, connections, online engagement and expert analysis.

Influencers are evaluated on a series of specific keywords related to the oil and gas supply sector, which they have tweeted in or around the last 90 days.

A more detailed daily analysis is available for GlobalData subscribers.