US hydrocarbon exploration company Anadarko has signed a Sale and Purchase Agreement (SPA) with Japanese power company JERA and Taiwanese oil and gas company CPC.

The SPA calls for the supply of 1.6 million tonnes per annum (MTPA) of liquefied natural gas (LNG) from Anadarko Mozambique Area 1 project, which JERA and CPC will jointly purchase over a period of 17 years.

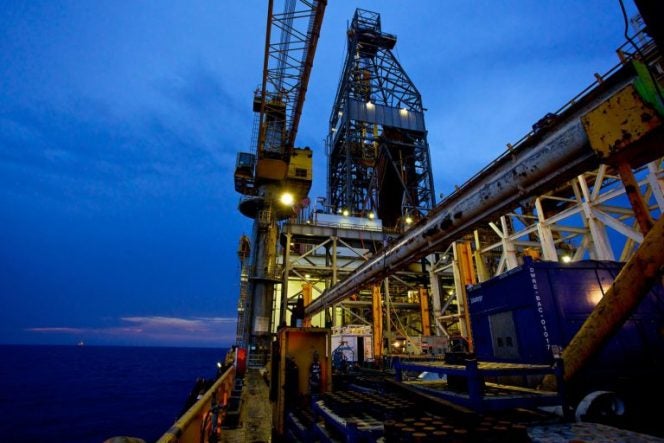

Anadarko is the operator of Offshore Area 1 through its subsidiary Anadarko Moçambique Área 1, with an operating interest of 26.5%. The company is developing Mozambique’s first onshore LNG facility to support the development of the Golfinho/Atum field in Area 1, which is expected to have a capacity of 12.88 MTPA.

Partners in the project include Mitsui E&P Mozambique Area 1 (20%), ENH Rovuma Área Um (15%), ONGC Videsh (10%), Beas Rovuma Energy Mozambique (10%), BPRL Ventures Mozambique (10%) and PTTEP Mozambique Area 1 (8.5%).

This agreement is the first long-term co-purchase with an overseas partner for CPC and JERA, and will enable the two companies to exchange LNG flexibly depending on supply and demand. The companies also hope to respond to uncertainties in domestic LNG supply and demand by using the “geographical advantage” of the Mozambique Area 1 project.

Anadarko executive vice president for International, Deepwater & Exploration Mitch Ingram said: “This co-purchasing agreement with JERA and CPC brings together two prominent Asian foundation customers and will ensure a reliable supply of cleaner energy to meet the growing demands of both Japan and Taiwan.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“We are excited to take the next step with the expected announcement of a final investment decision for the Mozambique LNG project on June 18, as we remain on track to complete the project financing process and secure final approvals.

“This new SPA brings our total long-term agreements to 11.1 MTPA, and we are extremely pleased and grateful to JERA and CPC for selecting Mozambique LNG to be part of their long-term energy portfolio.”

In a statement, JERA said: “This project enables JERA to expand opportunities for optimizing its LNG portfolio. JERA will continue to maximize its enterprise value and its ability to respond flexibly to changes in the business environment by building an appropriate LNG portfolio and optimizing its operations.

CPC added: “This joint purchase represents a cross-boundary LNG alliance in Asia Pacific. For decades, CPC has had a close partnership with Japanese and Korean LNG importers on cooperative basis.

“This joint purchase helps CPC to further achieve the flexibility of operation in dealing with the growing uncertainty of domestic gas demand in order to ensure the stability of supply into Taiwan’s market.”