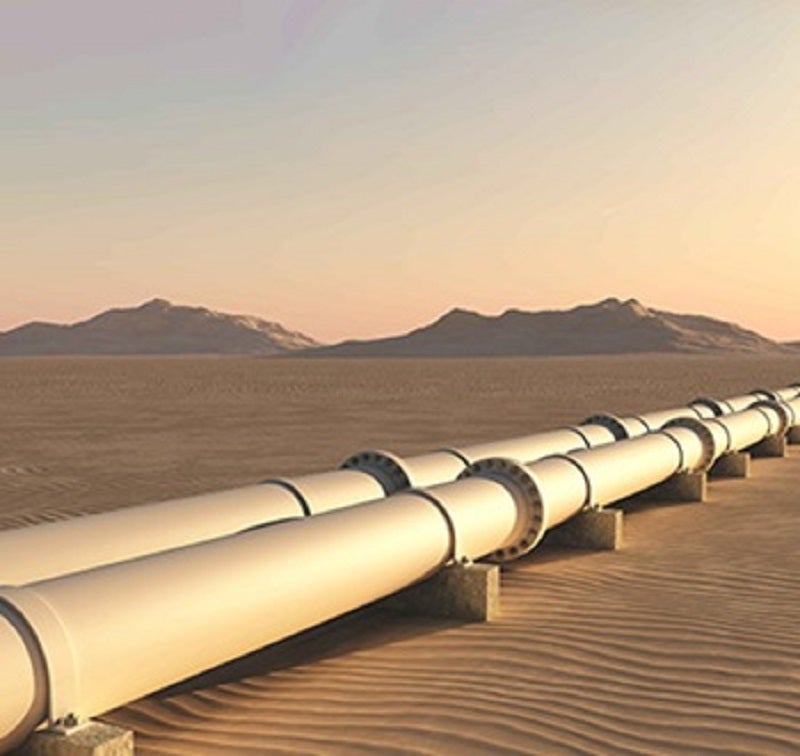

UAE’s Abu Dhabi National Oil Company (ADNOC) has reached a $20.7bn gas infrastructure deal with a consortium of investors.

The group consists of six investors, namely Global Infrastructure Partners (GIP), Brookfield Asset Management, Ontario Teachers’ Pension Plan Board, Singapore’s sovereign wealth fund GIC, NH Investment & Securities, and Snam.

In the gas deal, the consortium will collectively take a 49% stake in ADNOC Gas Pipeline Assets while the remaining 51% will be retained by ADNOC. The state-owned firm will maintain full operating control over the assets.

ADNOC Gas Pipeline Assets is a newly formed subsidiary of ADNOC.

UAE Minister of State and ADNOC Group CEO Sultan Al Jaber said: “This milestone transaction demonstrates the trust and confidence placed in ADNOC by the global investment community and unlocks significant value from our pipeline portfolio, following last year’s groundbreaking oil pipeline infrastructure investment partnership.

“Today’s landmark investment signals continued strong interest in ADNOC’s low-risk, income-generating assets, and sets another benchmark for large-scale energy infrastructure investments in the UAE and the wider region.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“It solidifies ADNOC’s position as an attractive partner and reinforces the UAE’s track record as the region’s go-to foreign direct investment destination, even during the current unprecedented circumstances.”

Under the deal, ADNOC will lease its ownership interest in the assets to its subsidiary ADNOC Gas Pipelines for a period of 20 years in return for a volume-based tariff.

It is expected to generate upfront proceeds of more than $10bn for ADNOC.

The transaction, which is the region’s largest energy infrastructure deal, is subject to customary closing conditions and necessary regulatory approvals.

Last month, ADNOC reported the generation of over AED3.67bn ($1bn) in business value from its Panorama Digital Command Center since its commissioning in 2018.