US-based extraction company Diamond Offshore and its subsidiaries have filed for chapter 11 bankruptcy, the parent company announced yesterday.

The company has given a statement saying it has enough funds to continue its global operations. It will continue to make investments in safety and reliability its upcoming reorganisation. A spokesperson said the company will use this to “strengthen its balance sheet, and achieve a more sustainable debt profile.”

Understanding how Diamond Offshore came to bankruptcy

In its end of year report for 2019, Diamond showed revenue declining for the tenth year in a row. Raw profit (EBITDA) decreased for the fourth year in a row, falling from $600m in 2018 to $100m in 2019. The report said this was partly down to unusually large spending on its ultra-deepwater drillships.

At the start of the year, the company had $2.6bn of debts. It also had $5.8bn of assets, including $500m of available cash.

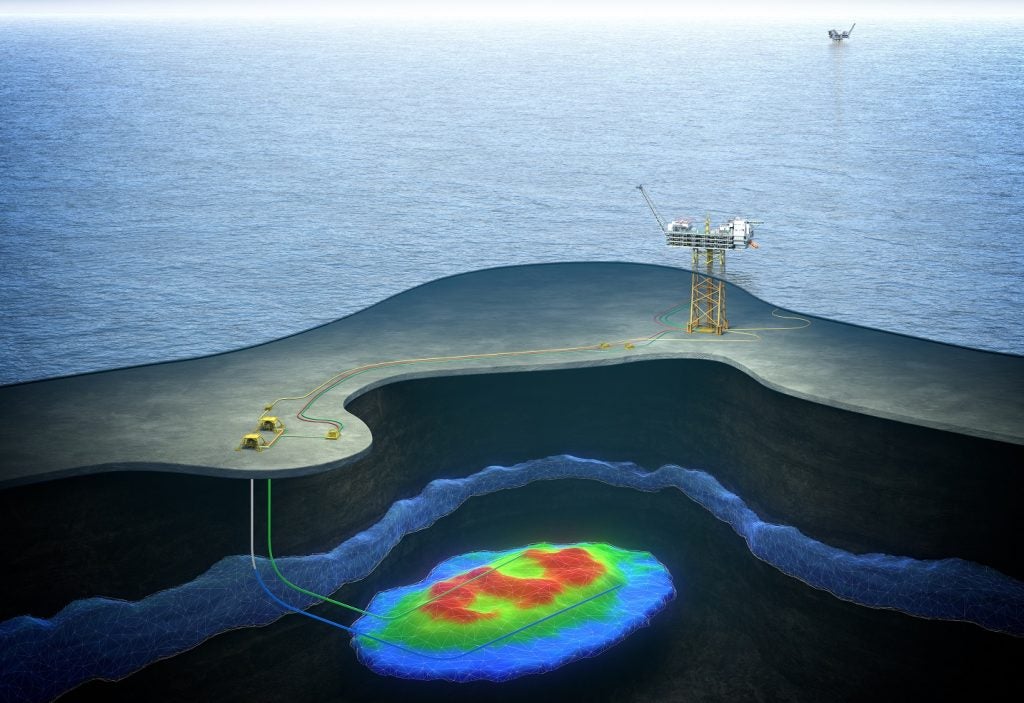

At the start of the year, its fleet had a backlog of work worth $1.6bn. The fleet itself consists of 11 semi-submersibles and four drillships.

Diamond Offshore Drilling owns 14 subsidiaries, including its downstream operations and arms in Brazil and UK. It also operates in Singapore, though a majority of its work takes place in the Gulf of Mexico.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataExecutives explain the filings

President and CEO Marc Edwards said “After a careful and diligent review of our financial alternatives, the Board of Directors and management, along with our advisors, concluded that the best path forward for Diamond and its stakeholders is to seek chapter 11 protection.

“Through this process, we intend to restructure our balance sheet to achieve a more sustainable debt level to reposition the business for long-term success.

“Diamond remains focused on maintaining its high standards as it relates to safety and operational excellence during the chapter 11 process. Our clients and vendors should expect business as usual across our organization as our world class team will stay steadfast on our collective goal of providing superior operations that clients have come to expect from Diamond Offshore.”