Lundin Energy has secured approval to begin production from the Phase 1 development of the Solveig field in the Norwegian North Sea.

The approval from the Norwegian Petroleum Directorate (NPD) allows the firm to start production later this year.

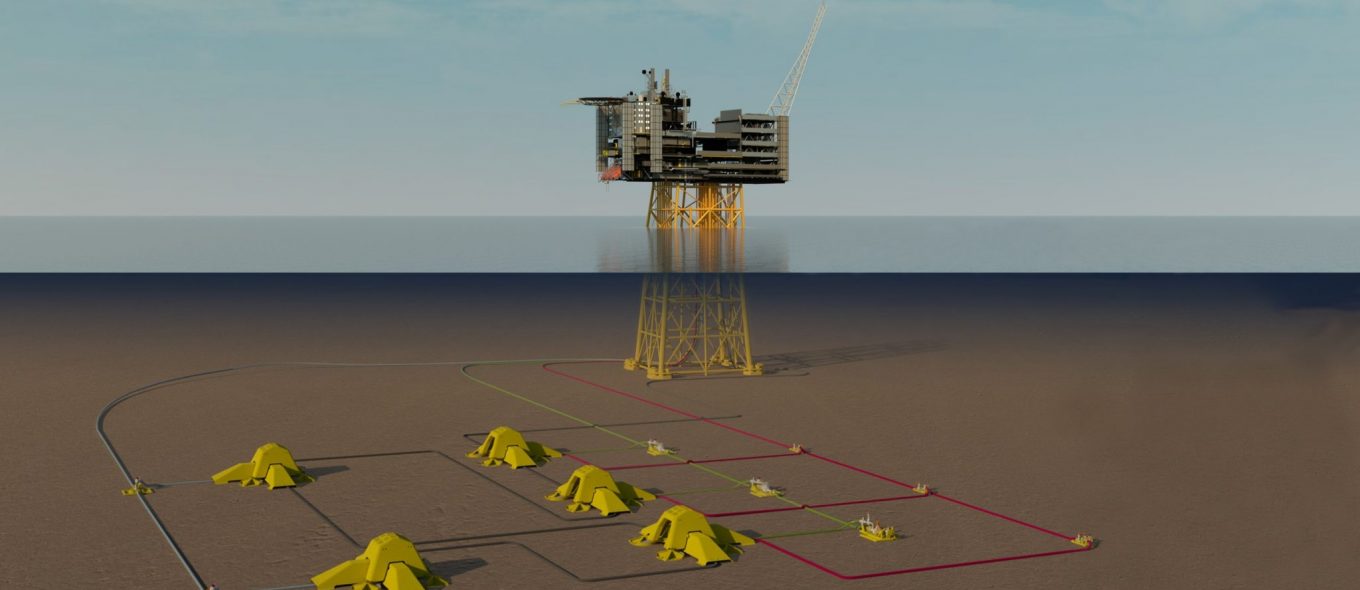

Located in the PL359 production licence in the Utsira High area of the North Sea, the Solveig oilfield will produce from subsea production facilities.

These facilities are tied into the Lundin Energy-operated Edvard Grieg field, located 15km away.

Production from the field will be processed at the Edvard Grieg platform prior to further transportation.

The Phase 1 development of the Solveig field includes three horizontal wells for oil production and two wells for water injection.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIn a press statement, NPD said: “The investment decision for Phase 2 will come later, based on experience and information from Phase 1.”

Developed with an estimated cost of $751.6m (Nkr6.5bn), the first phase of the Solveig field is estimated to hold recoverable reserves of 9.2 million standard cubic metres of oil equivalent.

The reserves include 44 million barrels per day (bbls) of oil, 1.44 billion standard cubic metres sales of gas, and 0.42 million tonnes of natural gas liquids (NGLs).

The offshore oil and gas field, which was discovered in 2013, is anticipated to produce up to 2041.

Lundin Energy, through its subsidiary Lundin Energy Norway, operates the field with a 65% stake. Other partners in the offshore Norwegian field include OMV (Norge) (20%) and Wintershall Dea Norge (15%).