The upstream sector recorded 188 awarded contracts in May 2017. Among the notable contracts in the upstream sector were Petroleum Development Oman’s two four-year contracts with a combined value of OMR300m ($776.6m) to Galfar Engineering & Contracting and Seeh Al Sarya Engineering for the off-plot mechanical works at oil fields in Qarn Alam, Fahud, Lekhwair, and Yibal area, and Vallianz Holdings’ three-year $115m contract for the charter of Offshore Support Vessels (OSVs) to support oil and gas operations in the Caspian Sea, offshore Turkmenistan.

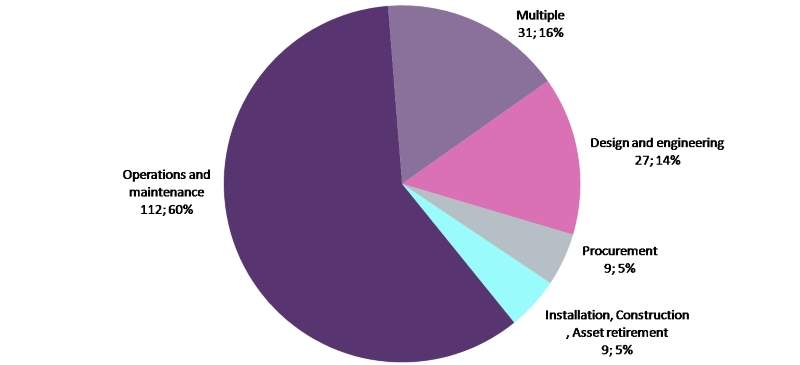

Operations and maintenance (O&M) accounted for 60% of the awarded upstream contracts. There were contracts for the charter of OSVs; Anchor Handling Tug Supply (AHTS) vessels; Platform Supply Vessels (PSVs); Multi Purpose Supply Vessels (MPSVs); drilling rigs; and Remotely Operated Vehicle (ROV) to support offshore oil and gas operations; provision of field management; well stimulation and completion services; and drilling and well technology services.

Design and engineering accounted for 14% of the awarded upstream contracts, with activities focused on engineering services including of conceptual studies and pre-Front End Engineering and Design (pre-FEED)/FEED for oil field development projects; semi-submersible platform and wellhead platforms; provision of seismic survey acquisition; subsurface imaging technology and studies related to drilling activities.

Upstream contracts by scope and count, May 2017

Source: Equipment and Services Analytics, GlobalData

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataContracts with multiple scopes, such as construction, design and engineering, installation, O&M, and procurement, accounted for 16% of the contracts awarded in the upstream sector in May 2017. There were contracts for the provision of engineering, procurement, fabrication and installation of wear protection on risers; Engineering, Procurement, Construction, and Installation (EPCI) of Subsea, Umbilicals, Risers, and Flowlines (SURF) package including risers, flowlines, and associated structures and jumpers; provision of towing, mooring installation, and hook-up services; engineering, procurement, fabrication, load-out, transportation, installation, hook-up, and pre-commissioning work of offshore platform; and provide services and products to support the design, fabrication, and installation of ancillary flowline hardware for field development projects.

Procurement accounted for a mere 5% of the awarded upstream contracts, which included the supply of differential pressure, electromagnetic, ultrasonic, and mass type flow meters; surface exploration wellhead equipment and steel structures for subsea facilities.

Related link