Wholesale gas prices in Europe rose once again in mid-November following new obstacles in the Nord Stream II pipeline and political games threatening disruption of gas supply to Europe.

Geopolitical risks underlining gas supply to Europe have to be addressed to avoid the deepening of the energy crisis.

European households and businesses could suffer an extended period of higher energy bills unless energy policies support gas supply in the mid-term by providing political concessions to Russia.

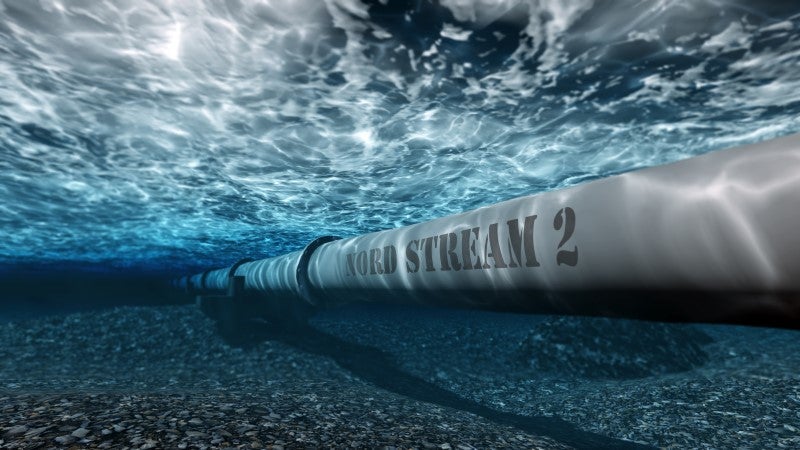

Gas, and extensively Nord Stream II, are vital to ensure energy stability

There is no doubt about the significance of the Nord Stream II pipeline for EU countries, which are reliant on imports of natural gas; nearly 75% of their consumption is covered by imports, with 40% covered by Russian gas imports.

The increasing reliance of the EU on renewable sources, such as solar PV and wind energy, which are inherently variable or intermittent is only heightening the need for demand-flexible natural gas-based generation, especially when the transition to sustainable energy sources is yet to be achieved.

Political games and geopolitical risks akin to European gas supply

The Nord Stream II pipeline has been completed after long delays in the midst of sanctions and geopolitical tensions arising from concerns of Europe becoming vulnerable from its higher energy reliance on Russia.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataObstacles for a launch of operations remain though; last week the German regulator suspended the approval process for Nord Stream II AG, the subsidiary operating the pipeline in German territory, as the company did not satisfy the condition of being an independent transmission operator, to ensure separate ownership of gas supply from pipeline transmission (unbundling) in line with the EU Gas Directive.

Its approval is still pending conditional on all assets and operations being transferred from the Swiss-based Nord Stream II parent company to ensure compliance with the German law.

Such regulatory scrutiny is ‘valid’ to prevent Gazprom, as the sole supplier of gas through the pipeline, to exercise control. In fact, Gazprom and the Russian Government have already tried to leverage the current energy crisis, claiming that a quick regulatory approval of the Nord Stream II, based on regulatory concessions, would increase supply and reduce price pressure.

What complicates things further are threats by the Belarusian president to cut gas supply from the Yamal-Europe pipeline in retaliation against any new EU sanctions.

Weathering energy crisis through political concessions and long-term contracts on gas supply

No concessions should be made in the Nord Stream II project to limit supply risks. It is political concession that needs to be made instead.

Since the energy crisis in Europe also has a political colour, energy policies have to adjust towards recognising the importance of gas in Europe’s energy security, also providing political concessions to Russia, such as the lift of economic sanctions, in order to gain energy concessions.

New long-term contracts of European energy companies – which have largely been abandoned in favour of spot markets – with Gazprom and other Russian gas suppliers could help European countries to sustain the current energy crisis.

In fact, Vladimir Putin stated a few weeks earlier that gas supplied by Gazprom to European companies under long-term contracts costs four times less than gas purchased on the spot market. Moreover, long-term contracts would also prevent the outflow of gas supply to Asian markets, which largely contributes to soaring gas prices in Europe.

Related Company Profiles

Nord Stream 2 AG

Gazprom