The capital expenditure outlook for the oil and gas industry depends on global economic dynamics, geopolitical situations and company cash flows. A healthy global economy ensures reliable demand for commodities, while a stable geopolitical environment guarantees steady supply chains. A company with strong cash flows can exploit this environment through strategic capital investments.

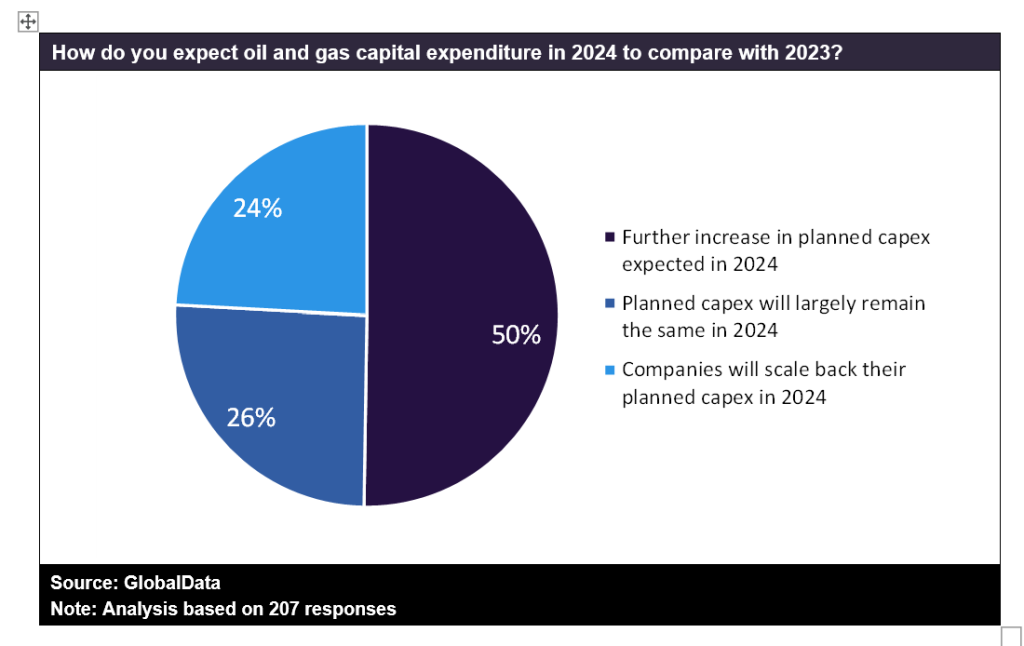

In October and November 2023, GlobalData conducted a poll to gauge the sentiment on the oil and gas industry capital expenditure (capex) outlook for 2024 in comparison to 2023. About half of the respondents voiced a positive outlook and opined that the capex for 2024 would show a notable increase.

The oil and gas market has relatively stabilised following the fallout from the Russo-Ukrainian conflict, and crude oil has seen strong demand in the last two years. Brent crude oil prices were relatively range-bound between $70 per barrel (bbl) and $90/bbl since January 2023. Company revenues have outperformed in the last couple of years and BP, Chevron, ExxonMobil, Saudi Aramco, Shell and TotalEnergies reported a year-on-year growth of more than 40% in revenues for 2022 as compared to 2021.

With energy security issues coming to the fore, the medium-term outlook for oil and gas demand is unlikely to decline rapidly in the next five to ten years. Furthermore, strategic production cuts that are regularly adopted by the OPEC+ group would help in sustaining high oil prices. High oil prices, robust company financials and strong demand reflect a favourable environment for increasing capex for 2024.

Over a quarter of the respondents said that they expect the capex for 2024 to remain largely the same as 2023. This may reflect a cautious view in the wake of global recession fears. Companies might look to shore up their finances to withstand any economic downturn before thinking about increasing their annual capex.

See Also:

The remaining share of respondents, slightly less than a quarter, believed that the 2024 capex would be scaled back compared to that of 2023. High inflation and rising interest rates tend to impact liquidity and access to capital for project financing. This might disincentivise companies from allocating capex for newer projects. Continued commitment towards energy transition could also be a factor in decreasing the annual capex in the oil and gas industry.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Related Company Profiles

Exxon Mobil Corp

Shell plc

TotalEnergies SE

BP Plc

Chevron Corp