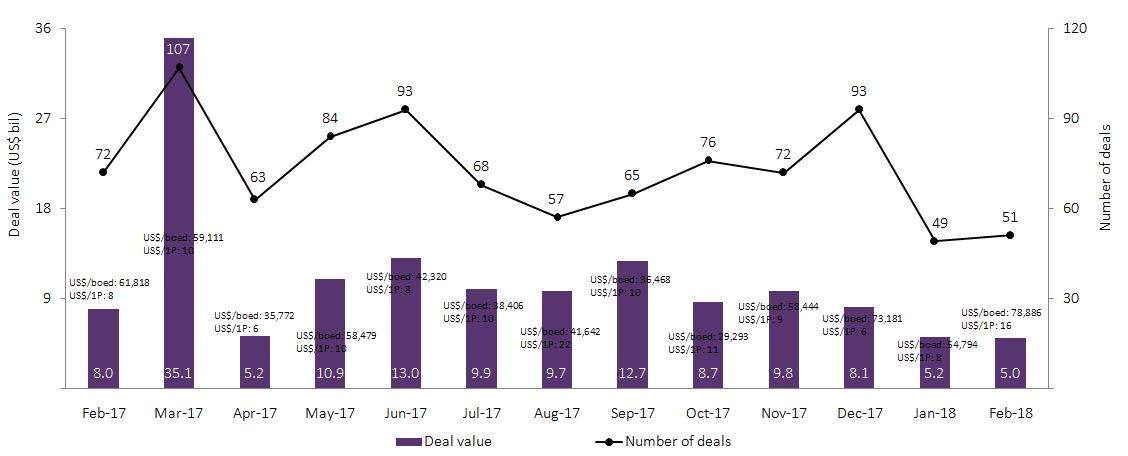

GlobalData’s latest report, ‘Monthly Upstream Deals Review – February 2018’, shows that a combined value of $5bn in mergers and acquisitions (M&A) were announced in the upstream sector in February 2018. This was a marginal decrease of 4% from the $5.2bn in M&A deals announced in the previous month. A year-on-year comparison shows a significant decrease of 38% in deal value in February 2018, when compared to February 2017’s value of $8bn. Of the total value, conventional acquisitions were worth $3.4bn; and unconventional acquisitions were worth $1.6bn. The month recorded 17 oil and gas M&A deals with values greater than $50m, together accounting for $4.8bn.

Noble Energy’s agreement to sell its oil and gas assets located in the deep waters of the Gulf of Mexico to Fieldwood Energy for approximately for approximately $810m was one of the top deals registered in February 2018.

The assets include interests in six producing fields and all undeveloped leases. The assets have a 2018-estimated average net production of more than 20,000 barrels of oil equivalent (boe) of daily production. As of December 31, 2017, the assets had total proved (1P) reserves of approximately 23 million barrels of oil equivalent (mmboe).

Following the completion of the transaction, Noble Energy will exit its business operations in the Gulf of Mexico. The transaction implies values of US$40,500 per boe of daily production and US$35.22 per boe of 1P reserves

Upstream M&A Deal Value and Count, February 2018

Source: Oil & Gas Deals Analytics © GlobalData

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataOn the volume front, the number of M&A deals increased by 4% from 49 in January 2018 to 51 in February 2018, of which 15 were cross border transactions and the remaining 36 were domestic transactions. Americas was the destination of choice for cross-border M&A activity in January 2018, recording seven cross-border transactions in the month.

Regionally, Americas led the global M&A market in terms of volume and deal value, with 34 deals worth a combined value of $3.3bn, representing 67% of the global deals and 66% of the total value in February 2018. The Europe Middle East and Africa (EMEA) registered 12 deals or 24% of the total, of a combined value of $316.8m; while Asia-Pacific recorded five deals, or 10% of the total, with a value of $1.4bn in February 2018.