Williams Companies has completed the acquisition of MountainWest Pipelines Holding from Southwest Gas Holdings for an enterprise value of $1.5bn.

The divestment is part of Southwest Gas’ plan to simplify its portfolio of businesses. The deal follows a months-long battle with activist investor Carl Icahn.

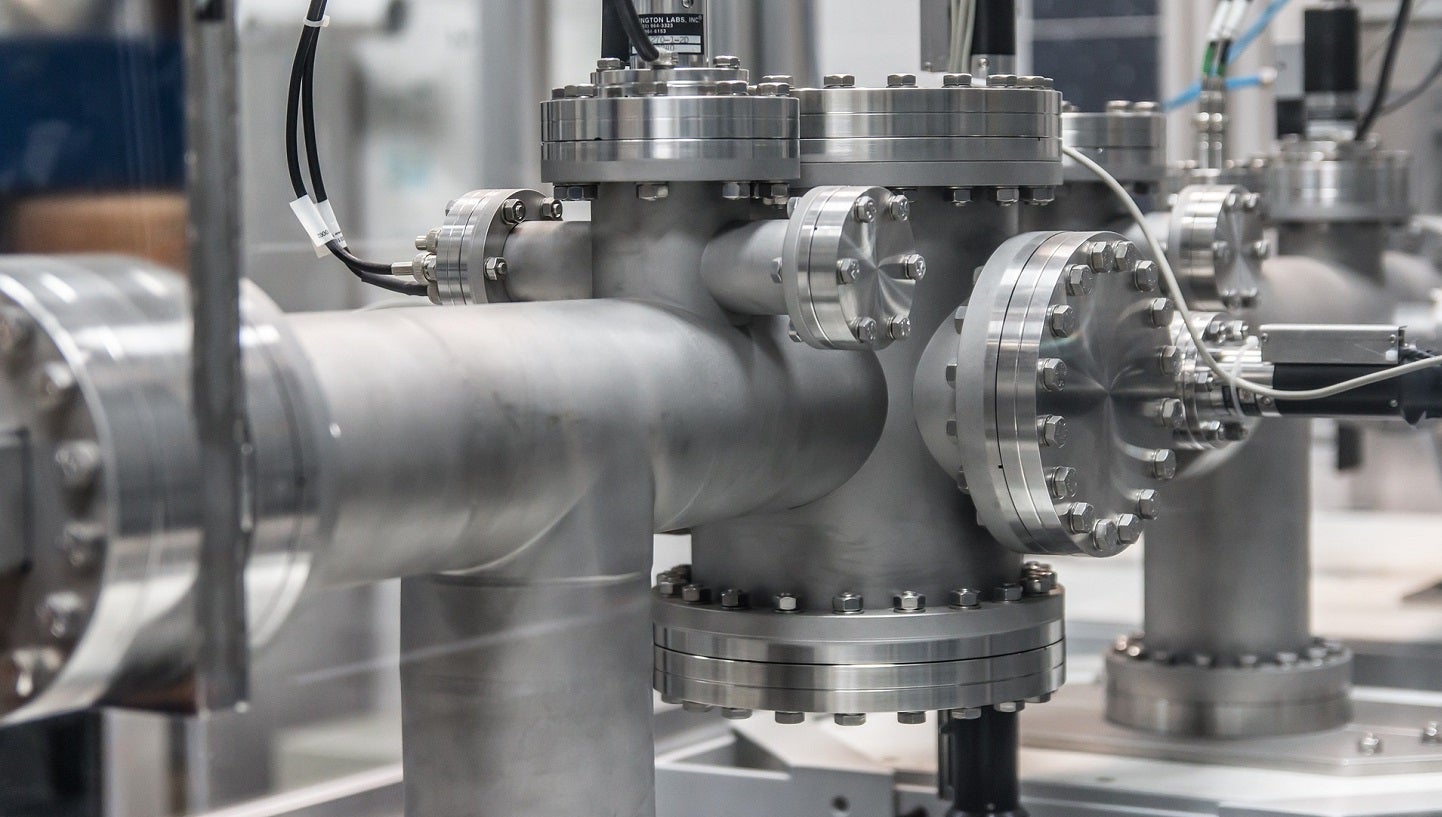

MountainWest business includes approximately 2,000 miles of interstate natural gas pipeline systems primarily located across Utah, Wyoming, and Colorado.

These pipeline systems have a transmission capacity of approximately eight billion cubic feet (bcf) per day.

The natural gas transmission and storage business also owns 56bcf of total storage capacity, including the Clay basin underground storage reservoir.

Southwest Gas plans to use proceeds from the sale to repay its term loan of nearly $1.07bn.

Southwest Gas president and CEO Karen S Haller said: “This is a significant step toward returning Southwest Gas to its core regulated utility business of providing reliable, sustainable, and affordable energy to meet the expectations of customers and communities while continuing to maximise its growth potential.

“We look forward to continuing to enhance our focus as we move forward with the planned spin-off of Centuri to create two focused industry leaders.”

Southwest Gas plans to completely spin off its owned subsidiary Centuri Group to create a new, independent, publicly traded utility infrastructure services company during Q4 2023 or Q1 2024.

Williams president and CEO Alan Armstrong said: “This acquisition enhances our position in the western US and is complementary to our current footprint, providing us with infrastructure for natural gas deliveries across key demand markets.”

With the acquisition, Williams intends to expand its infrastructure network and strengthen its FERC-regulated natural gas transmission and storage business.